Unlocking the potential of sustainable bonds for financing climate resilience: the Climate Bonds Resilience Taxonomy

Today has seen the launch of the Climate Bonds Resilience Taxonomy (CBRT) during New York Climate Week. This exciting development offers the potential to scale up market action on financing climate resilience (also referred to as adaptation) by providing clear and consistent definitions of climate resilience investments – in other words, a common vocabulary for climate resilience financing that can be used by broad range of stakeholders including investors, issuers, regulators and policymakers.

The CBRT builds upon Climate Bonds’ extensive experience of taxonomy development and extends their existing Climate Bonds Taxonomy into the increasingly urgent, but comparatively under-funded, area of climate resilience. Cadlas is pleased to be the Lead Technical Partner on this ground-breaking initiative, having worked closely with Climate Bonds since 2022 to bring in our extensive, practical experience of climate resilience financing.

The sustainable bonds market represents a significant source of financing for sustainable development, with total sustainable bond issuances now exceeding USD 5 trillion. However, only a small fraction of the capital raised through these issuances currently addresses climate resilience. While Climate Bonds’ analysis suggests that around 19% of labelled green bond issuances include climate resilience (or adaptation) as an eligible use of proceeds (UoP), evidence suggests that only a small fraction of this financing is being challenged into climate resilience investments.

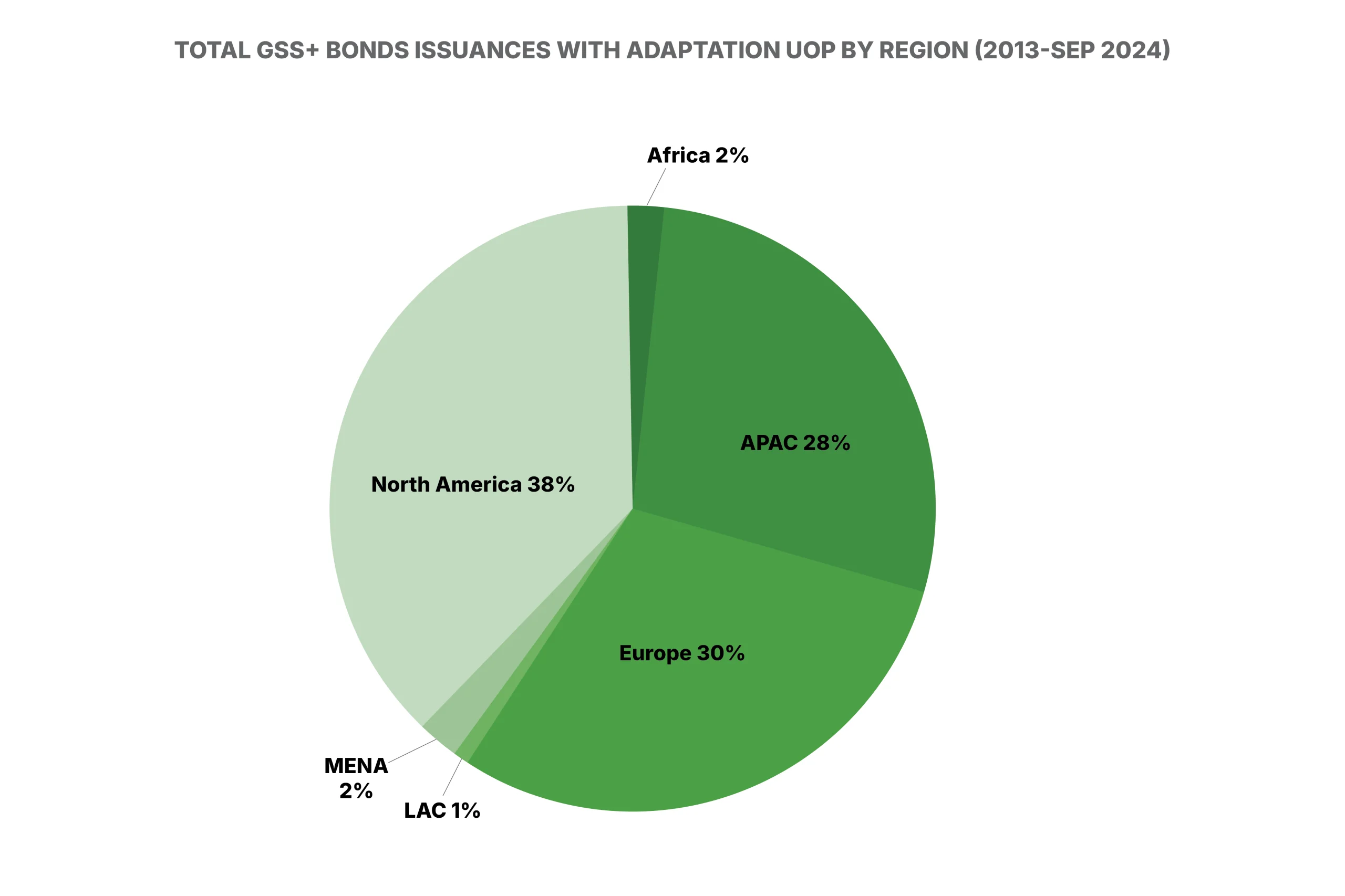

Nonetheless, sustainable bonds are potentially a key instrument for mobilizing investment in climate resilience. Since the City of Gothenburg first included adaptation as an eligible UoP in its 2013 green bond issuance, market activity has progressively increased so that today around 2,500 sustainable bonds issuances have included adaptation as an eligible UoP, while a total volume of just over USD 1 trillion. While most of this activity has taken place in Europe, North America and the Asia-Pacific (APAC) region, there is a need for greater action in Africa, Latin America & the Caribbean (LAC), and the Middle East & North Africa (MENA) regions, where sustainable bond volumes with adaptation UoP remain relatively low despite these being some of the most climate-vulnerable regions of the world with significant climate resilience investment needs.

This highlights the need for much greater flows of financing for climate resilience, as the frequency and severity of climate change impacts – and their economic and human costs – continue to accelerate. For example, the United Nations estimates that developing countries need up to 18 times more adaptation finance than is currently provided. Furthermore, at present more than 98% of reported adaptation finance is provided by public institutions such as development finance institutions (DFIs), which highlights the need for much greater action on mobilising private finance for climate resilience.

An important obstacle to private finance mobilisation for climate resilience has been a lack of clarity on definitions and criteria for climate resilience investments. This creates uncertainty for both investors and issuers and hinders the flow of capital. While sustainable finance taxonomies can play an important role in directing private and public investments toward sustainability goals, they have hitherto not given due attention to climate resilience as an investment theme.

To date, climate resilience has tended to take a back seat to climate mitigation (or decarbonisation) objectives in sustainable finance taxonomies, with a lack of consistency in the sectoral coverage and breakdown of climate resilience financing. This has been compounded by process-based definitions that are difficult for users to apply, and a lack of clear eligibility criteria for determining whether an investment is meaningfully contributing to climate resilience.

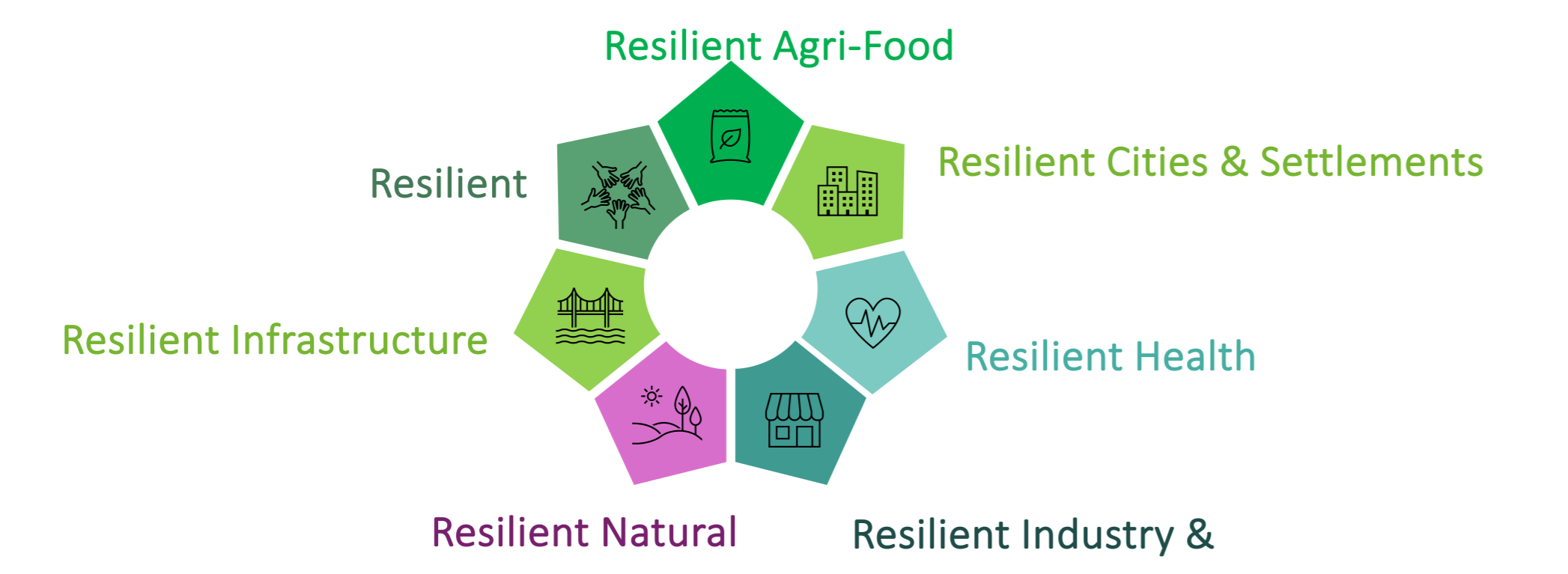

The CBRT directly addresses these challenges by providing a credible classification system for climate resilience investments. It offers focused, detailed guidance on climate resilience, an area often under-prioritised or addressed only broadly in many existing taxonomies. The CBRT provides clear, consistent and comprehensive coverage of climate resilience investments based on six Climate Resilience Themes. This covers a broad range of investment types ranging from financing the adoption of specific climate resilience measures within investments to financing economic activities that provide A&R solutions.

The CBRT fills a critical market need for a common foundation that helps investors identify and scale up finance for a wide range of investments that genuinely contribute to building climate resilience. It addresses three critical gaps:

- Clear, Science-Based Definitions and Criteria: The CBRT provides clear, science-based definitions and criteria for identifying investments that substantially contribute to climate resilience. This is essential for overcoming the lack of clarity that has hindered resilience finance flows to date.

- Navigating the Regulatory Landscape: The CBRT helps investors and companies navigate the evolving regulatory landscape. It aligns with and advances beyond regulatory standards like the EU Sustainable Finance Taxonomy, providing a rigorous, globally applicable framework for demonstrating the climate resilience credentials of investments.

- Flexibility and Adaptability: The CBRT has been designed to be flexible and adaptable to diverse country contexts and investor needs. This is crucial for building resilience, which requires tailored approaches that reflect local vulnerabilities and priorities. The format of the CBRT also allows for further improvements and tailoring to be added over time.

The next exciting chapter in the CBRT story begins now, as it begins to be taken up and put to use by issuers, investors, regulators, policymakers and others. The CBRT will not only enhance transparency for investors by eliminating certain information asymmetries but also support the alignment of global capital flows with local resilience needs and opportunities underpinned by rigorous, science-based eligibility criteria.

As Cadlas continues to collaborate with partners across the finance landscape to enhance resilience financing in various country contexts and investor mandates, we are confident in the CBRT’s applicability across multiple use cases – particularly as it relates to the sustainable debt market. By supporting a range of issuers, investors and other participants in applying and using the CBRT, we can enhance the effectiveness and impact of climate resilience investments, driving more capital towards projects that are crucial for adapting to and mitigating the effects of climate change.

Cadlas is committed to fostering a resilient future by enabling more informed and impactful investments in climate adaptation and resilience. Stay tuned for more updates on how the CBRT is set to transform the landscape of climate finance.

Other Articles