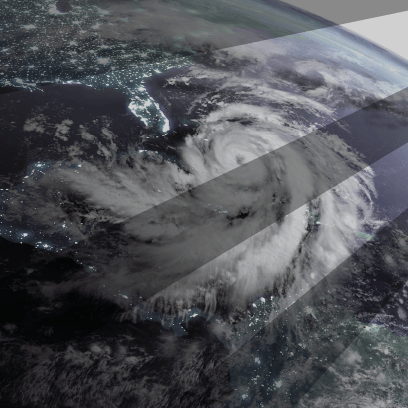

Insights from Climate Bonds CONNECT 2024: Fostering Resilience in a Changing World

From discussions about transition planning for corporates to the path to achieving interoperability and innovative models for scaling up finance for resilience, Climate Bonds CONNECT 2024 was filled with valuable insights and impactful discussion sessions around adaptation and resilience.

The jam-packed day began with Climate Bonds Initiative (CBI) CEO, Sean Kidney’s opening speech where he emphasized the need for global effort on building resilience to climate change given that it is a global challenge.Furthermore, efforts to avoid catastrophic climate change continue to be hindered by a range of crises, including socioeconomic inequality, health and food security concerns, all of which are exacerbated by climate change itself. These challenges require international cooperation and coordination, particularly around adaptation and resilience.

Mr. Kidney underscored this point by noting that climate change will adversely impact the planet irrespective of global progress on mitigation/decarbonisation. As a result, it is necessary now, more than ever to scale up action on adaptation and resilience. While the challenges around decarbonisation/mitigation are well documented this is not the case for resilience/adaptation. However, he noted that tools like CBI’s recently launched Climate Bonds Resilience Taxonomy, for which Cadlas served as the lead technical partner, provide important guidance and clarity on a range of urgent priorities for building resilience. In closing out his speech Mr. Kidney said that despite the enormity of the challenges surrounding climate change, he is still hopeful that we can work together to find a solution. He pointed out that “we are a hive species” intimating our need to work collectively to solve global challenges and cited the ‘green revolution’ and the role of technology as great opportunities.

Immediately following Mr. Kidney’s speech was Torsten Albrecht, Principal Investment Officer at the Asian Infrastructure Investment Bank (AIIB), who spoke about AIIB and the role of multilateral development banks (MDBs) in supporting the green, social and sustainable (GSS+) bonds market, particularly in emerging economies. He highlighted AIIB’s goal to achieve sustainable economic development through infrastructural projects and the bank’s work to actively scale up private sector participation in climate focused projects. Mr. Albrecht noted that despite the encouraging growth of the GSS+ bonds market in developed markets, there is still a sizeable finance gap and more focus should be placed on emerging markets to help close this gap. This was followed by session 1, a panel discussion on opportunities for corporates and countries around transition planning.

After a brief networking and coffee break, attendees were back in the plenary for session 2 on interoperability between taxonomies which was moderated by CBI’s Director of Thought Leadership, Anna Creed. There are over 45 national or regional taxonomies in existence across the globe, with more in development. While this is necessary given the range of geographical contexts and differing levels of development, it presents a significant reporting challenge to investors and regulators. Panellists highlighted the need for and importance of comparability, equivalence and disclosures in achieving interoperability between taxonomies. Following this was a networking lunch which preceded the second 5-minute OnSwitch session on the Asian Development Bank’s work in the GSS+ bonds market in Southeast Asia.

Immediately after this was what CEO Sean Kidney pointedly referred to as the most highly anticipated session of the day. Session 3 was entitled ‘Innovating for Resilience: Scaling-up Proven Models to Catalyze the $3 Trillion Opportunity’ and was moderated by CBI’s Director of Strategic Programmes, Ujala Qadir. Before jumping into the discussion, Ms. Qadir asked panellists to share how climate change has personally impacted their lives within the last year. Several panellists spoke about their experiences with increased rainfall, flooding, extreme heat, landslides and hurricanes which set the tone for the panel discussion and underscored the importance of adaptation and resilience. She noted that we already have solutions and the capital, but they needed to be repackaged to direct finance towards adaptation and resilience. Panellist Gerald Evelyn, Invesco’s Senior Client Portfolio Manager, cited the use of blended finance in driving institutional investment towards building resilience in the world’s most climate vulnerable regions. He noted that there has been significant interest from institutional investors in Invesco’s Climate Adaptation Action Fund.

Lasitha Perera, the co-founder and CEO of the Development Guarantee Group, also highlighted the usefulness and opportunity guarantees provide, pointing out that “guarantees have mobilised the most private capital but are the most underused.” He noted that many adaptation and resilience investments, especially in emerging markets, sit in sub-investment grade countries. While simultaneously instilling confidence in investors, guarantees provide access to private finance for investees and countries that are often excluded because traditional institutional investors rely on ratings as an indicator of risk. The conversation then continued to the role of MDBs in scaling up finance for adaptation and resilience in which Xianfu Lu, Consultant on Adaptation and Climate Resilience at AIIB, noted that the capital is already there and MDBs already have several processes in place to track adaptation finance, but these efforts are hindered by a lack of “good projects in the pipeline.” In agreement with Ms. Lu, British International Investment (BII) Managing Director of Climate, Diversity and Advisory, Amal-Lee Amin, pointed out that while development finance institutions (DFIs) and MDBs can help build out the pipeline, governments needed to work on creating ‘enabling environments’ for project development. She also noted the importance of collaboration in managing risk and building capacity to scale up finance for resilience. Panellists also spoke about the importance of metrics for helping investors to understand and gain greater transparency around resilience issues and needs. In concluding the session, Ujala Qadir cited the usefulness of the Climate Bonds Resilience Taxonomy in helping investors to understand the impact of their investments on building resilience.

Lasitha Perera, the co-founder and CEO of the Development Guarantee Group, also highlighted the usefulness and opportunity guarantees provide, pointing out that “guarantees have mobilised the most private capital but are the most underused.” He noted that many adaptation and resilience investments, especially in emerging markets, sit in sub-investment grade countries. While simultaneously instilling confidence in investors, guarantees provide access to private finance for investees and countries that are often excluded because traditional institutional investors rely on ratings as an indicator of risk. The conversation then continued to the role of MDBs in scaling up finance for adaptation and resilience in which Xianfu Lu, Consultant on Adaptation and Climate Resilience at AIIB, noted that the capital is already there and MDBs already have several processes in place to track adaptation finance, but these efforts are hindered by a lack of “good projects in the pipeline.” In agreement with Ms. Lu, British International Investment (BII) Managing Director of Climate, Diversity and Advisory, Amal-Lee Amin, pointed out that while development finance institutions (DFIs) and MDBs can help build out the pipeline, governments needed to work on creating ‘enabling environments’ for project development. She also noted the importance of collaboration in managing risk and building capacity to scale up finance for resilience. Panellists also spoke about the importance of metrics for helping investors to understand and gain greater transparency around resilience issues and needs. In concluding the session, Ujala Qadir cited the usefulness of the Climate Bonds Resilience Taxonomy in helping investors to understand the impact of their investments on building resilience.

After this, the day continued with even more insightful sessions on the role of finance in advancing sustainable agriculture, the use of sustainable land bonds to finance nature-based carbon capture and storage as well as transparency and reporting in the GSS+ bonds market. In his spirited closing remarks, Sean Kidney invited attendees to share their own reflections on the day’s discussions and reiterated his hopefulness and excitement for the future.

Other Articles