Welcome to the third instalment of Resilience Unpacked, Cadlas’ insights series exploring key topics in climate resilience finance. In this edition, we explore how investors can use stewardship and engagement to drive climate resilience.

In Part 1 of this series on investor stewardship, we’ll look at how physical climate change impacts are emerging as a mega-trend for the investment industry and how responsible investment and climate resilience are increasingly integral to investors’ fiduciary duty.

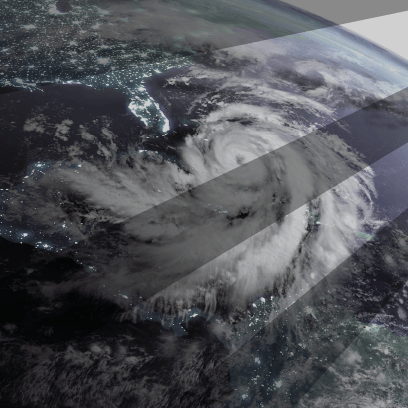

As physical climate impacts intensify, investors are increasingly recognising the need to move beyond physical climate risk assessment and disclosure to support companies and assets in maintaining long-term value while adapting to a changing and more variable climate. In 2025, the World Economic Forum ranked extreme weather among the top risks to the global economy, while S&P Global estimated that the world’s largest companies could face annual costs of up to USD 1.2 trillion by 2050 due to physical climate risks. These figures underscore a clear message: the financial implications of a changing climate are material, measurable and mounting.

For the investment industry, this means adaptation and resilience can no longer be treated as peripheral sustainability issues. They must become central to how capital is allocated, how risks are managed and how long-term value is created and maintained.

Beyond Risk Disclosure

Over the past decade, the investment community has made meaningful progress in understanding and reporting on physical climate risks. Disclosure frameworks that cover climate scenario analysis, disclosure and risk assessment are now well established in a number of jurisdictions. However, most of these efforts still focus on assessing and disclosing physical climate risks, but often stopping short of responding to them. As climate impacts accelerate, investors will increasingly need to turn that analysis into action. This means using stewardship, including engagement with companies, influencing governance and exercising ownership rights, to build resilience within the companies and markets they invest in.

At its core, the shift is about turning climate awareness into climate action and recognising that resilience is not just a defensive measure, but a strategic imperative that protects and enhances long-term value.

Cadlas’ Investor Stewardship for Climate Resilience Sourcebook was developed in consultation with leading investors and investment industry associations to set out what this looks like in practice. It provides a blueprint that investors may use to embed physical climate risk considerations into their stewardship strategies and to work collectively to strengthen climate resilience across portfolios and markets. Importantly, it takes a pragmatic approach, offering pathways that investors can integrate into existing stewardship processes rather than creating entirely new initiatives.

Resilience and Fiduciary Duty

For investors, climate resilience is becoming an essential component of fiduciary duty. Acting with prudence and care in the face of physical climate risks requires understanding how those risks could affect assets, portfolios and broader market systems. It also requires supporting investee companies to anticipate, manage, and adapt to those risks effectively.

Reducing exposure to – or even divesting from – high-risk sectors or geographies may reduce portfolio exposure in the short term, but it can also undermine systemic resilience by cutting off capital from where it is most needed to build resilience. In contrast, maintaining engagement and using stewardship to encourage stronger risk management, adaptive planning and capital investment in resilience can drive both financial and social value. This approach parallels the logic of how responsible investment addresses decarbonisation challenges. Just as responsible investors understand that they need to stay engaged in hard-to-abate sectors to support low-carbon transition, they must also stay engaged in climate-vulnerable sectors to support their journey towards climate resilience.

However, investors’ approaches will differ based on their mandate, capacity, and risk appetite.

- Risk appetite: Investors with a higher risk appetite may choose to allocate capital to emerging resilience solutions or invest in companies operating in climate-vulnerable regions, recognising the potential for higher impact and longer-term value creation. Those with a lower risk appetite may instead focus on well-established resilience strategies or investments with more predictable risk-return profiles.

- Market of operation: Investors operating in markets that are highly exposed to physical climate risks may prioritise direct engagement with portfolio companies to strengthen adaptive capacity, while investors in more mature markets with stronger policy frameworks may focus on advancing market-level solutions.

- Size and capacity: Larger investors are often equipped to conduct detailed physical risk assessments, integrate resilience into governance and strategy, and lead collaborative stewardship initiatives. Smaller investors may need to prioritise the most material risks and leverage partnerships, pooled engagements, or service providers to extend their reach.

Whatever the approach, the key principle is consistency: ensuring that climate resilience is recognised as integral to fiduciary responsibility and long-term value creation.

- Integrate physical climate risk into investment policies, processes, and decision-making;

- Use robust data and scenario analysis to identify, understand, and manage material physical risks;

- Engage with portfolio companies and managers to strengthen governance, strategy, risk management, and disclosure around climate resilience;

- Identify and pursue opportunities that contribute to building resilience across markets and value chains; and

- Monitor, evaluate, and report on resilience performance and stewardship outcomes.

To explore this topic in more depth, download the Cadlas Investor Stewardship for Climate Resilience Sourcebook here or follow our Resilience Unpacked series on our website and our LinkedIn page. We welcome feedback on this topic and invite investors, policymakers and practitioners interested in advancing climate resilience through stewardship to connect with Cadlas at [email protected]

Stay tuned for Part 2, where we will unpack how investor stewardship for climate resilience can be applied in practice and explore approaches for structuring effective engagement for climate resilience.

Other Articles