Cadlas collaborates with Climate Bonds on the Development of a Climate Resilience Taxonomy for Sustainable Bonds

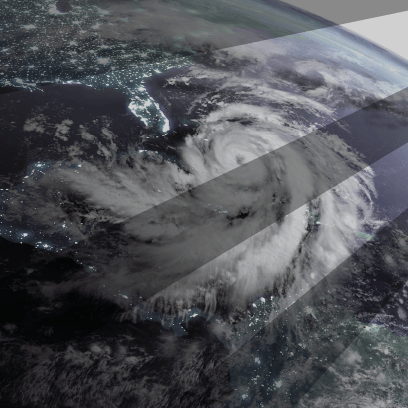

As the impacts of climate change become more evident and increasingly material for governments and companies alike, the need to identify and scale up sources of finance for investment in climate resilience becomes ever more pressing.

Green, social, sustainable and sustainability-linked (GSS+) bonds offer huge potential for accessing capital markets for scaling up urgently needed investment in climate resilience. The USD 3.7 trillion GSS+ debt market enables projects and entities such as corporates, sovereign and sub-sovereigns to access finance for sustainable investments in support of the low-carbon transition, social objectives or other sustainability themes – including climate resilience.

Climate resilience already features in GSS+ bonds, with 19% of GSS+ debt instruments having some degree of climate resilience UoP. Recent examples of issuances covering climate resilience include New Zealand’s sovereign green bond and the Arizona Industrial Development Authority’s sustainability-linked bond. In addition, dedicated climate resilience (or climate adaptation) bonds have been issued by the EBRD (2019) and the AIIB (2023).

However, in order to realise the potential of GSS+ debt instruments for financing climate resilience, a clear and systematic framework for issuers and investors is required. This is why Cadlas is pleased to have supported Climate Bonds on the first phase of the development of their Climate Resilience Taxonomy for sustainable bonds. The Climate Bonds Climate Resilience Taxonomy White Paper sets out a clear, upstream framework for defining climate resilience investments that may be eligible for GSS+ bond issuances oriented towards climate resilience.

The White Paper identifies seven ‘climate resilience themes’, covering resilient agri-food systems, resilient cities, resilient health, resilient industry and commerce, resilience infrastructure, resilient nature and biodiversity, and resilient societies. Across those themes, investments may be categorised according to the level of assessment that they require – enabling those investments with clear climate resilience benefits and low risk of significant harm to other sustainability objectives to move ahead more quickly.

Establishing a common language for issuers, investors and other stakeholders to use will be instrumental for harnessing the potential of GSS+ debt instruments for financing climate resilience. The White Paper lays out a solid foundation for the further development of this work over the next few years.

Other Articles