Welcome to the Cadlas Newsletter!

Welcome to the first edition of the Cadlas Quarterly Newsletter! Each edition will provide valuable insights into the latest trends and developments in climate resilience finance, covering topics such as sustainable bonds, climate resilience taxonomies, and more. This newsletter is also an excellent way to stay up-to-date on the Cadlas team and our work!

The Launch of the Climate Bonds Resilience Taxonomy

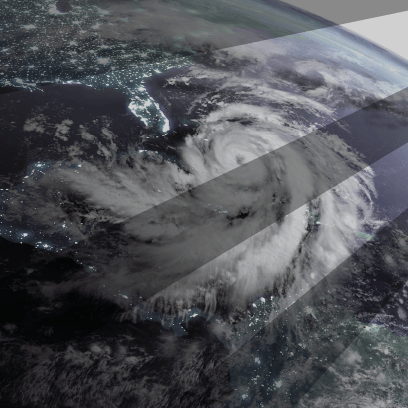

The launch of the Climate Bonds Resilience Taxonomy (CBRT) in September 2024 marks a significant advancement in climate resilience financing.

This initiative provides a clear vocabulary for these investments, fostering collaboration among investors, issuers, regulators, and policymakers.

The CBRT builds upon Climate Bonds’ extensive experience of taxonomy development and extends their existing Climate Bonds Taxonomy into the increasingly urgent, but comparatively under-funded, area of climate resilience.

Cadlas is proud to be the Lead Technical Partner on this ground-breaking initiative, having worked closely with Climate Bonds since 2022 to bring in our extensive, practical experience of climate resilience financing.

Climate Resilience and Sustainable Industrial Development: UNIDO’s Climate Adaptation Week

Cadlas CEO Craig Davies shared Cadlas’ perspectives on the role of the financial sector in supporting private sector action on climate adaptation as part of a Climate Adaptation Week organised by the United Nations Industrial Development Organisation (UNIDO) on 14-15 October. Building climate resilience is absolutely central to UNIDO’s core mission of inclusive and sustainable industrial development.

In addition to securing its own climate resilience, the industrial base also has a vital role to play in delivering the solutions and innovation that is urgently needed to build a climate-resilient economy at scale.

Cadlas Participation in the ADB CAIP Forum

Cadlas recently made significant contributions to the Asian Development Bank‘s Climate Adaptation Investment (CAIP) Forum in Manila, connected to our ongoing work with the ADB on this topic. Our Senior Specialist in Climate Resilience, Noah Wescombe, delivered a key presentation on climate resilience bonds, showcasing Cadlas’s role as the Lead Technical Partner in developing the Climate Bonds Resilience Taxonomy. This presentation marked a crucial step in connecting climate adaptation to tangible investment modalities, generating substantial interest among forum attendees.

In addition to presenting, Cadlas actively participated in technical discussions and led an investment planning clinic with the representatives of national Armenian delegations. This engagement provided valuable insights into structuring sustainability-linked loans and highlighted the necessary enabling environments for scaling such products. Cadlas’s involvement underscored our expertise in climate resilience financing and our commitment to advancing practical solutions for adaptation investments across diverse national contexts.

Cadlas Supports the GEF’s Climate Adaptation Innovation & Learning Project on Climate Change Adaptation Information Flows for the Financial Sector

The financial sector needs improved information on climate change adaptation to direct funds toward investments that enhance the real economy’s climate resilience.

Cadlas is delighted to be working alongside an impressive array of partner organisations including UNEP-FI, UNIDO, Climate-KIC and the Global Adaptation and Resilience Investment (GARI) group to implement this important GEF project. In particular, Cadlas is providing technical support to UNEP-FI on climate change adaptation impact measurement and information flows over 2024-25.

From the Insights Blog:

From discussions about transition planning to the challenges with achieving interoperability between taxonomies and innovative models for scaling up finance for resilience, Climate Bonds CONNECT 2024 was filled with valuable insights and impactful discussion sessions around adaptation and resilience.

From discussions about transition planning to the challenges with achieving interoperability between taxonomies and innovative models for scaling up finance for resilience, Climate Bonds CONNECT 2024 was filled with valuable insights and impactful discussion sessions around adaptation and resilience.

Cadlas in the News:

In a recent interview with Environmental Finance, Cadlas CEO Craig Davies highlighted that while interest and momentum around adaptation-themed sustainable bonds is growing, significant investment opportunities are still being overlooked. Despite a substantial increase in bond issuances in recent years, actual allocations to adaptation and resilience investments remain low. In particular, he pointed out an almost pervasive misalignment between adaptation strategies and eligible investments at the sub-sovereign level within sustainable bond frameworks.

As investors continue to recognize the revenue-generating potential of these investments, Davies emphasized the need for a clear taxonomy to enhance market understanding of adaptation and resilience.

Cadlas CEO, Craig Davies, recently joined the Climate Proof podcast to discuss the current state of financial regulation related specifically to adaptation and whether targeted regulatory development could potentially help mobilities capital for adaptation.

Within the last decade, financial regulators across the globe have begun to enforce mandatory climate-related disclosures on companies and financial institutions including rules on “green funds” labelling. However, despite this increased regulatory action, adaptation and resilience have been largely neglected.

Find Us Here

Cadlas will be attending the Climate Financial Risk Forum (CFRF) adaptation working group launch in November 2024

Other Posts