Cadlas Newsletter: April 2025 Issue

Welcome to the Cadlas Newsletter!

Welcome to the third issue of the Cadlas Quarterly Newsletter! Each issue will provide valuable insights into the latest trends and developments in climate resilience finance, covering topics such as sustainable bonds, climate resilience taxonomies, and more. This newsletter is also an excellent way to stay up-to-date on the Cadlas team and our work!

Cadlas recently hosted Resilience Unpacked: The Role of National Platforms in Unlocking Adaptation Investment, a timely webinar on moving from climate adaptation planning to financing.

The session featured rich insights from Nanki Kaur (ADB), Michael Mullan (OECD), Bouke de Vries (independent expert and former advisor to the Executive Board of Rabobank) and Danielle Evanson (Government of Barbados, Roofs-to-Reefs Programme), who shared practical insights on how national platforms can align public investment, mobilise private finance, and build systemic resilience.

Speakers emphasised the need to embed economic analysis into adaptation planning to demonstrate the benefits of proactive investment over the costs of inaction. They stressed the importance of integrating adaptation into public financial management systems, enabling stronger cross-government coordination, and designing institutional structures that can steer both public and private finance. Innovative financial instruments such as Barbados’ debt-for-nature and debt-for-climate swaps were showcased as examples of how to scale investment through coherent, nationally driven platforms.

Read more insights from the webinar here and click here to watch the webinar recording!

Represented by Senior Specialist for Climate Resilience, Noah Wescombe, Cadlas co-delivered the “Scaling Up Climate Adaptation Finance” workshop at the recently held UNEP-FI Regional Roundtable on Sustainable Finance for Latin America & the Caribbean in São Paulo, contributing to a dynamic regional dialogue on mobilising capital for climate resilience.

The session highlighted the need for locally relevant taxonomies, alignment with national policies and the integration of meaningful KPIs to drive accountability and impact. A clear takeaway was the power of collaboration in unlocking scalable adaptation solutions.

Cadlas has been actively working on this agenda and is currently collaborating with the Climate Bonds Initiative to advance the development of their Climate Bonds Resilience Taxonomy, a robust framework designed to guide and scale investment in climate adaptation across global markets. Read more insights from this workshop here.

Cadlas and ADB Explore Mechanisms for Scaling Up Climate Adaptation Investment

Cadlas, in collaboration with the Asian Development Bank (ADB), has analysed the potential for Project Preparation Facilities (PPFs) in supporting climate adaptation investments. This work examines the role of PPFs in catalysing adaptation finance in Asia and the Pacific.

The Asia-Pacific region faces a significant adaptation finance gap, with annual investment needs estimated between $102-431 billion, far exceeding the $34 billion in adaptation finance flows in 2021-2022. PPFs can help bridge this gap by providing technical and financial support to develop bankable adaptation projects.

The analysis profiles existing PPF initiatives in select ADB member countries to identify best practices and common challenges. It offers recommendations for scaling up effective PPFs, including ensuring operational flexibility and strategic alignment with national priorities, developing sustainable financing strategies, strengthening capacity building functions, fostering innovation, and addressing key implementation challenges. By supporting the development of a robust pipeline of investable adaptation projects, PPFs can help accelerate and scale up adaptation action in the region. The outputs of this work can guide ADB member countries and development partners in establishing and strengthening PPFs as an integral component of their adaptation finance strategies.

Stay tuned for the full release of this work in the form of a concept note on the ADB and Cadlas websites in the near future.

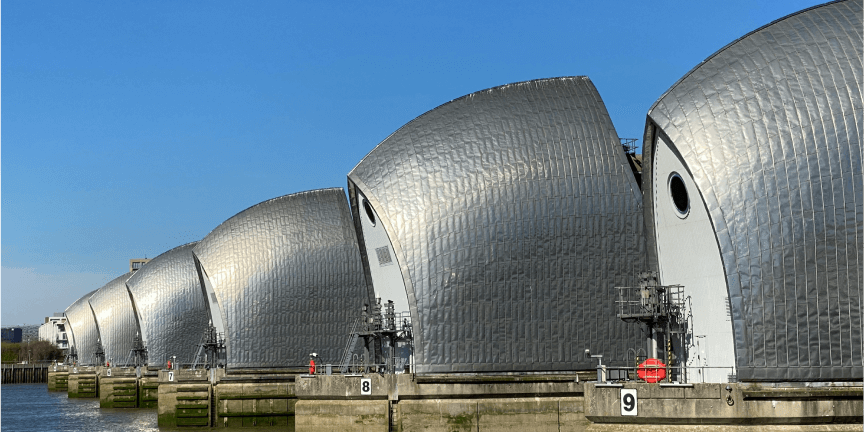

The real estate sector is highly vulnerable to climate change impacts ranging from the increasing occurrence of extreme heat events to more frequent damaging floods. In addition to the risks to real estate assets and investment portfolios, these also pose significant threats to livelihoods, well-being and health. Recent analysis by the influential think tank I4CE examines the role of the financial sector in helping to adapt the real estate sector to a changing and more extreme climate.

This calls for coordinated action across commercial banks, property insurance companies and asset management firms, both to support appropriately structured investments in real estate adaptation, and in providing financial services that improve the enabling environment for climate resilient investment in the sector.

Cadlas was pleased to contribute to this leading-edge analysis through expert reviewer inputs from our CEO Craig Davies, building on our first-hand experience of working with a range of financial institutions on climate resilience in the built environment.

The full report can be read here on the I4CE website.

From the Insights Blog:

In early March, Cadlas Analyst Aiesha Joseph attended Project Dandelion’s annual convening in Bellagio, Italy, where she joined leading women at the intersection of gender and climate justice.

The experience led to deep reflections on the links between climate resilience finance and gender equality, highlighting the significant challenges women face in accessing climate adaptation finance. This issue is particularly pressing in developing countries, where the adaptation finance gap remains vast. Aiesha also noted the limited integration of gender considerations in climate finance, with only a small portion of funds currently addressing these disparities.

Despite growing awareness, less than 5% of public adaptation finance in 2022 was gender-responsive, and only 1% of green, social, and sustainability bonds included gender objectives. To bridge this gap, Aiesha emphasises the need to rethink how we fund resilience by innovating inclusive financial tools, integrating gender into finance design, and improving data systems for tracking impact.

Read more of Aiesha’s insights here.

Cadlas in the News:

Investment in climate adaptation is being held back by fragmented, incremental planning, according to a recent Environmental Finance article covering Cadlas’ webinar, Resilience Unpacked: The Role of National Platforms in Unlocking Adaptation Investment. ADB’s Nanki Kaur highlighted that many National Adaptation Plans (NAPs) narrowly focus on production like seeds or water use while neglecting the full value chain, limiting investment appeal. For instance, Armenia’s resilient horticulture plans lacked market clarity, deterring banks. Bhutan offers a stronger model with its Climate Adaptation Investment Plan (CAIP), clustering actions into 11 water-sector packages with system-wide thinking and clear financing pathways, including private and blended finance.

To scale up climate adaptation financing through green bonds, clearer taxonomies and stronger public sector participation are essential, said the OECD’s Michael Mullan during Cadlas’ Resilience Unpacked: The Role of National Platforms in Unlocking Adaptation Investment webinar, as reported by Environmental Finance. Mullan emphasized that public issuers like France and MDBs such as the EBRD help build market familiarity. However, a key barrier remains knowing what qualifies as adaptation investment. The Climate Bonds Initiative’s new Resilience Taxonomy, launched in late 2024, aims to define eligible activities, reduce transaction costs, and help adaptation find its place in the growing sustainable bond market.

Opportunities for financing a climate resilient Scotland

In early March, Cadlas Analyst Aiesha Joseph attended a workshop hosted by the Scottish Government and ClimateXChange, focused on advancing climate adaptation finance in Scotland.

The event brought together academics, policymakers, and financial services to explore opportunities for tackling Scotland’s climate adaptation challenges. Discussions centred on innovative funding mechanisms, private and public sector collaboration, and how to align financial flows with adaptation needs to close the finance gap.

Cadlas @ London Climate Action Week

Exciting news, the Cadlas team will be attending LCAW 2025! Look out for more details soon on our LCAW events!

Other Posts

Cadlas Newsletter: January 2025 Issue

Welcome to the Cadlas Newsletter!

Welcome to the second edition of the Cadlas Quarterly Newsletter! Each edition will provide valuable insights into the latest trends and developments in climate resilience finance, covering topics such as sustainable bonds, climate resilience taxonomies, and more. This newsletter is also an excellent way to stay up-to-date on the Cadlas team and our work!

Global Environment Facility’s (GEF) Climate Adaptation Innovation & Learning Project Launch

In vulnerable developing countries, private investment in climate adaptation falls short of needs due to barriers like limited climate data, unclear impact metrics, and a lack of collaborative frameworks. The Climate Adaptation Innovation Learning (CAIL) project tackles these issues by fostering innovation and private sector engagement, connecting financial stakeholders in climate-vulnerable regions through three Communities of Practice (CoP).

Cadlas is pleased to serve as the technical partner for the Climate Change Adaptation Information Flows & Impact Measurement CoP, which focuses on consolidating and enhancing the understanding and use of climate-related information flows, empowering the financial sector to make scalable, impactful adaptation investments.

CAIL is financed by the Global Environment Facility and implemented by the UNIDO in partnership with Climate-KIC, Global Adaptation & Resilience Investment Working Group (GARI) and United Nations Environment Programme Finance Initiative (UNEP FI).

Cadlas is especially proud to see Barbados at the forefront of implementing innovative climate finance solutions for climate resilience such as the world’s first debt-for-climate swap. Supported by the Inter-American Development Bank, the European Investment Bank and commercial banks, this transaction swaps Barbados’ sovereign debt for more affordable financing, unlocking $125 million in fiscal savings which will be used to enhance water security and climate resilience.

Cadlas has previously collaborated with the Inter-American Development Bank on sustainability-linked sovereign debt instruments. This explored how sovereign debt management can be aligned with national climate resilience priorities and outlined a model for climate resilience performance measurement and target-setting. We are thrilled to see these ideas in action, paving the way for other climate-vulnerable nations to enhance resilience.

The financial sector is increasingly recognizing the emerging opportunities tied to climate adaptation and resilience. While progress has been made in improving the level of private sector investment, much more is needed to create the enabling conditions for a thriving adaptation and resilience market.

Cadlas is proud to have contributed to the development of the ‘Call for Collaboration’ recommendations, formulated during roundtable discussions hosted by the Atlantic Council’s Climate Resilience Center and the High-Level Climate Champions with public and private sector stakeholders. These recommendations outline six key actions to create enabling environments for mobilizing private finance for adaptation and resilience.

The potential for sustainable bonds to support the scaling up of financing for climate resilience took a major step forward in November, when the state of California approved a proposition for a USD 10 billion bond issuance to raise finance for responding to the impacts of climate change. These funds will be used to raise finance for investments that build resilience to a range of climate change impacts that California faces – many of which were brought into sharp focus through the devasting wildfires that destroyed thousands of homes in the Los Angeles area during January 2025.

While the bulk of the funds (USD 3.8 billion) will go towards water sector investments such as improving water quality, coping with floods and droughts, and the restoration of freshwater bodies such as rivers and lakes, a number of other climate resilience priorities are also covered. These include allocations of USD 1.95 billion for coping with wildfires and extreme heat, USD 1.9 billion for protecting natural habitats and wildlife, and USD 1.2 billion for coastal and marine protection, as well as funding for clean energy and agricultural projects.

From the Insights Blog:

Introducing Resilience Unpacked, Cadlas’ insight blog series providing an in-depth exploration of key topics in climate resilience financing. This first instalment will focus on national platforms and their role in mobilising finance for climate resilience.

National platforms for climate action are increasingly being recognised as important mechanisms for advancing national climate adaptation goals. These government-led partnerships foster collaboration among development partners and other stakeholders, aligning efforts with a shared strategic vision and national priorities. These platforms are essential for mobilising and directing finance towards investments that align with national adaptation and resilience priorities, fostering both focus and a sense of ownership over these priorities.

Read more here to learn how these platforms can help to mobilise finance for adaptation by bridging the gap between high-level national adaptation plans and financeable investments.

Cadlas in the News:

Responsible Investor: Adapting to the New Climate Realities

In a recent interview with Responsible Investor, Cadlas CEO Craig Davies highlighted the importance of clear, widely recognised definitions of adaptation and resilience, such as those outlined in the Climate Bonds Resilience Taxonomy (CBRT), in attracting private investment to the space. By specifying what qualifies as an adaptation activity, the CBRT seeks to empower bond issuers to design innovative financial instruments that inspire investor confidence. Davies also expressed his optimism that the CBRT would play a pivotal role in boosting private sector engagement in financing climate adaptation and resilience initiatives.

Check Out Our New Website

We’re excited to announce that our website has a brand new look! Check it out here!

Other Posts

Cadlas Newsletter: October 2024 Issue

Welcome to the Cadlas Newsletter!

Welcome to the first edition of the Cadlas Quarterly Newsletter! Each edition will provide valuable insights into the latest trends and developments in climate resilience finance, covering topics such as sustainable bonds, climate resilience taxonomies, and more. This newsletter is also an excellent way to stay up-to-date on the Cadlas team and our work!

The Launch of the Climate Bonds Resilience Taxonomy

The launch of the Climate Bonds Resilience Taxonomy (CBRT) in September 2024 marks a significant advancement in climate resilience financing.

This initiative provides a clear vocabulary for these investments, fostering collaboration among investors, issuers, regulators, and policymakers.

The CBRT builds upon Climate Bonds’ extensive experience of taxonomy development and extends their existing Climate Bonds Taxonomy into the increasingly urgent, but comparatively under-funded, area of climate resilience.

Cadlas is proud to be the Lead Technical Partner on this ground-breaking initiative, having worked closely with Climate Bonds since 2022 to bring in our extensive, practical experience of climate resilience financing.

Climate Resilience and Sustainable Industrial Development: UNIDO’s Climate Adaptation Week

Cadlas CEO Craig Davies shared Cadlas’ perspectives on the role of the financial sector in supporting private sector action on climate adaptation as part of a Climate Adaptation Week organised by the United Nations Industrial Development Organisation (UNIDO) on 14-15 October. Building climate resilience is absolutely central to UNIDO’s core mission of inclusive and sustainable industrial development.

In addition to securing its own climate resilience, the industrial base also has a vital role to play in delivering the solutions and innovation that is urgently needed to build a climate-resilient economy at scale.

Cadlas Participation in the ADB CAIP Forum

Cadlas recently made significant contributions to the Asian Development Bank‘s Climate Adaptation Investment (CAIP) Forum in Manila, connected to our ongoing work with the ADB on this topic. Our Senior Specialist in Climate Resilience, Noah Wescombe, delivered a key presentation on climate resilience bonds, showcasing Cadlas’s role as the Lead Technical Partner in developing the Climate Bonds Resilience Taxonomy. This presentation marked a crucial step in connecting climate adaptation to tangible investment modalities, generating substantial interest among forum attendees.

In addition to presenting, Cadlas actively participated in technical discussions and led an investment planning clinic with the representatives of national Armenian delegations. This engagement provided valuable insights into structuring sustainability-linked loans and highlighted the necessary enabling environments for scaling such products. Cadlas’s involvement underscored our expertise in climate resilience financing and our commitment to advancing practical solutions for adaptation investments across diverse national contexts.

Cadlas Supports the GEF’s Climate Adaptation Innovation & Learning Project on Climate Change Adaptation Information Flows for the Financial Sector

The financial sector needs improved information on climate change adaptation to direct funds toward investments that enhance the real economy’s climate resilience.

Cadlas is delighted to be working alongside an impressive array of partner organisations including UNEP-FI, UNIDO, Climate-KIC and the Global Adaptation and Resilience Investment (GARI) group to implement this important GEF project. In particular, Cadlas is providing technical support to UNEP-FI on climate change adaptation impact measurement and information flows over 2024-25.

From the Insights Blog:

From discussions about transition planning to the challenges with achieving interoperability between taxonomies and innovative models for scaling up finance for resilience, Climate Bonds CONNECT 2024 was filled with valuable insights and impactful discussion sessions around adaptation and resilience.

From discussions about transition planning to the challenges with achieving interoperability between taxonomies and innovative models for scaling up finance for resilience, Climate Bonds CONNECT 2024 was filled with valuable insights and impactful discussion sessions around adaptation and resilience.

Cadlas in the News:

In a recent interview with Environmental Finance, Cadlas CEO Craig Davies highlighted that while interest and momentum around adaptation-themed sustainable bonds is growing, significant investment opportunities are still being overlooked. Despite a substantial increase in bond issuances in recent years, actual allocations to adaptation and resilience investments remain low. In particular, he pointed out an almost pervasive misalignment between adaptation strategies and eligible investments at the sub-sovereign level within sustainable bond frameworks.

As investors continue to recognize the revenue-generating potential of these investments, Davies emphasized the need for a clear taxonomy to enhance market understanding of adaptation and resilience.

Cadlas CEO, Craig Davies, recently joined the Climate Proof podcast to discuss the current state of financial regulation related specifically to adaptation and whether targeted regulatory development could potentially help mobilities capital for adaptation.

Within the last decade, financial regulators across the globe have begun to enforce mandatory climate-related disclosures on companies and financial institutions including rules on “green funds” labelling. However, despite this increased regulatory action, adaptation and resilience have been largely neglected.

Find Us Here

Cadlas will be attending the Climate Financial Risk Forum (CFRF) adaptation working group launch in November 2024

Other Posts