Welcome to the second instalment of Cadlas’ new insight blog series, Resilience Unpacked, where we explore key topics in climate resilience financing. In this edition, we focus on National Platforms for Adaptation and Resilience Investment.

National platforms or country platforms for climate action are country-led partnerships that align financing, coordinate stakeholders and connect national climate policies with financeable projects. They enhance collaboration, streamline funding and maximise climate impact by bridging the gap high-level national adaptation plans and financeable investments.

As demand for adaptation finance grows globally, national platforms are increasingly identified as important mechanisms for mobilising investment in climate adaptation and resilience initiatives. Strengthening and expanding these platforms will be key to transforming national climate policy ambitions into investable projects and unlocking the full potential of climate resilience investments for a more resilient future.

In Part 1 of our Resilience Unpacked series on national platforms, we explored exactly what they are and how they function. Now, we’ll take a closer look at their structure, organisation and the key stakeholders driving their work. Click here to read part 1 of this series

Structure of National Platforms for Adaptation & Resilience

As explored in Part 1, national platforms for climate action integrate climate considerations into investment pipelines by embedding them into strategy, operations and decision-making processes.

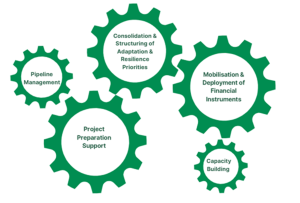

While there is no universal model, these platforms typically achieve their objectives by consolidating national climate priorities, supporting project preparation and capacity building, enhancing project pipeline management and mobilising innovative financial instruments.

A defining characteristic of national platforms is that they are country-driven, meaning their structure varies based on national context. Despite differences in governance and institutional setup, these platforms generally engage a diverse set of stakeholders, including government entities, the private sector, civil society (including academia), and, in many cases, international organisations.

Stakeholder Roles in National Platforms

Stakeholders within national platforms work together to set the platform’s strategic direction, align investments with national adaptation priorities, mobilise funding, and develop investable adaptation project pipelines.

They also build institutional capacity, manage risks, coordinate community engagement to ensure local adaptation needs are met, and streamline funding between national governments and international financial institutions. These stakeholders generally fall into two main categories: leading and supporting stakeholders.

Leading Stakeholders

- Leading stakeholders play a key role in integrating national adaptation priorities into investment planning and financial supervision.

Supporting Stakeholders

- Supporting stakeholders help incorporate adaptation into sectoral investment planning and align community-level adaptation goals with national priorities.

- Depending on the institutional context, there may be other supporting stakeholders which contribute by managing risk and data, aligning projects with finance priorities, coordinating international funding, providing climate risk modelling, and promoting equity in adaptation efforts.

National Platforms in Action: Examples from Around the World

While national platforms have been widely used to support climate mitigation efforts, not many examples exist of their application in scaling up finance specifically for adaptation and resilience. However, international support for adaptation-focused national platforms is growing, with a consortium of MDBs publishing guiding principles for their development and implementation.

Key initiatives driving this momentum include the:

- Asian Development Bank’s (ADB) Climate Adaptation Investment Planning (CAIP) , which helps ADB partner countries translate national adaptation priorities into robust investment programmes by leveraging existing structures and strategies.

- International Monetary Fund’s (IMF) Resilience and Sustainability Facility (RSF ), which provides long-term financing to help countries strengthen economic resilience to climate risks.

As mentioned previously, the structure of a national platform varies based on country-specific needs and governance models. The following examples illustrate these differences, showcasing distinct stakeholder roles and levels of involvement.

The Netherlands Sustainable Finance Platform

Chaired by the De Nederlandsche Bank (DNB), the Netherlands’ Sustainable Finance Platform (SFP) is a great example of a financial sector driven national platform. The SFP brings together stakeholders across the financial sector including asset managers, the Dutch Banking Association, insurers and pension funds to work with government ministries to promote sustainability in the Netherlands through its financial sector.

A core feature of this platform is its working groups, which shape the platform’s thematic focus. Importantly, the SFP features an Adaptation Working Group which examines how the financial sector can support economic adaptation to climate change in four key sectors: built environment, agriculture, industry and transport. The group assesses scenarios, methods, and data required for financial institutions to evaluate climate risks and adaptation needs. While its outcomes are non-binding, its recommendations play an important role in strengthening collaboration between financial institutions, the government, and other stakeholders, ensuring that adaptation challenges are linked to financial sector actions.

The Bangladesh Climate and Development Platform

Bangladesh is among the most climate-vulnerable nations, making climate adaptation finance an urgent priority. Launched in 2023, the Bangladesh Climate and Development Platform (BCDP) is a government-led initiative established in collaboration with international financial institutions, bilateral donors, and the private sector. While not exclusively focused on adaptation and resilience, the platform aims to generate a robust pipeline of climate projects and financing strategies.

Building upon financing from long-term international development financing partners and an arrangement with the IMF’s Resilience and Sustainability Facility, the BCDP aims to improve the integration of climate risks into fiscal planning, enhance climate-sensitive public investment management and strengthen climate-related risk management for financial institutions. Under the BCDP, a project preparation facility will also be established to enhance project bankability, making climate projects more scalable and attractive to private investment.

The Way Forward for National Platforms for Adaptation & Resilience

By streamlining stakeholder collaboration, national platforms have become important mechanisms for mobilising finance for adaptation & resilience. The examples of the Netherlands and Bangladesh highlight how platforms can be tailored to meet country-specific needs to build resilience to the growing challenges of climate change.

As the demand for adaptation finance continues to rise, the success of these platforms will depend on strong, inclusive partnerships and a clear focus on locally led solutions.

This concludes our Resilience Unpacked series on National Platforms for Adaptation & Resilience. Thank you for joining us on this deep dive into national platforms and stay tuned for more from the Resilience Unpacked blogs series!

Other Articles