Welcome to the second instalment of Resilience Unpacked, Cadlas’ insights series exploring key topics in climate resilience finance. In this edition, we examine sustainability-linked financing and its potential to support greater private investment in climate adaptation.

Results-based financing mechanisms such as Sustainability-Linked Bonds (SLBs) and Sustainability-Linked Loans (SLLs) tie financial terms to the achievement of sustainability goals. This creates incentives for companies to meet environmental performance targets. If structured around climate resilience-related Key Performance Indicators (KPIs), these instruments could channel much-needed private capital into adaptation measures at the corporate and entity level while setting powerful incentives for improving corporate performance on climate resilience.

Despite their growing popularity in supporting mitigation-focused corporate sustainability goals, SLBs and SLLs rarely incorporate adaptation and resilience objectives. This represents an underutilised opportunity to drive progress on adaptation and resilience. However, there may be important lessons from the application of sustainability-linked instruments in water-related investments that provide avenues for their potential role in financing climate resilience.

What are SLBs and SLLs?

Sustainability-Linked Bonds (SLBs) are general-purpose bonds that link financing terms, such as interest rates, to the achievement of predefined sustainability-related Key Performance Indicators (KPIs). If an issuer meets or falls short of its sustainability targets, financial terms may be adjusted accordingly.

Sustainability-Linked Loans (SLLs) function similarly but are structured as loans between a given lender and a given borrower, rather than bonds which are issued to raise funds from capital markets. Their terms also adjust based on performance against agreed sustainability KPIs.

Both instruments present an opportunity to incentivise investment in resilience by directly tying financing terms to progress on climate adaptation metrics. However, this opportunity has not been widely utilised across markets.

Limited Usage of Adaptation & Resilience Related KPIs

Despite the surge in sustainability-linked finance, adaptation KPIs remain strikingly rare. Research by Cadlas into global SLB issuances, using the Environmental Finance Database, found no examples of any specific adaptation or resilience KPIs included in global SLB issuances to date.

This trend was also observed in SLLs, with our research finding only one instance of climate adaptation as a KPI. HB Reavis, a UK-based real estate firm, secured a USD 32.4 million SLL in February 2024, which included a KPI linked to the number of EU Taxonomy-aligned buildings designed for climate adaptation. However, limited public information makes it hard to assess the robustness of this KPI.

This scarcity suggests potential uncertainty among issuers about how to define, implement, and measure adaptation KPIs. One key barrier is an unaddressed need for standardised guidance for adaptation-related KPIs in sustainability-linked finance.

Need for Clearer Guidance on Target Setting for Adaptation & Resilience

The International Capital Market Association (ICMA), a globally recognised standard-setting body, currently provides a limited number of KPIs that could convincingly be considered adaptation-related in the June 2024 iteration of its KPI Registry.

These are found in the Energy and Insurance (assets) sectors, representing only two out of ICMA’s twenty-six sectors. Within the Energy sector the adaptation-related KPI related to Share of energy produced in alignment with the EU Adaptation Taxonomy. While the KPI for the Insurance (assets) sector referred to the Proportion of invested assets managed with climate adaptation objectives.

Beyond these, ICMA lists three additional KPIs loosely linked to adaptation and all found within the Utilities (electricity) sector, but these lack clear resilience-focused outcomes. These include:

- Increase additional transformer capacity to facilitate interaction with the grid and integrate renewable energy generation,

- Increase power usage effectiveness/efficiency

- Renewable energy capacity (absolute or proportional).

This highlights the need for more detailed, targeted guidance on adaptation-related KPIs that are suitable for use in sustainability-linked debt instruments. Such guidance could build on existing best practices in financial sector adaptation and resilience metrics, such as the ARIC Adaptation & Resilience Impact Measurement Framework for Investors, developed in collaboration with UNEP-FI and Cadlas.

Water KPIs as a Proxy for Resilience in SLBs and SLLs

While adaptation-focused KPIs remain largely absent, water-related KPIs have gained significant traction, potentially serving as a stepping stone for broader resilience financing.

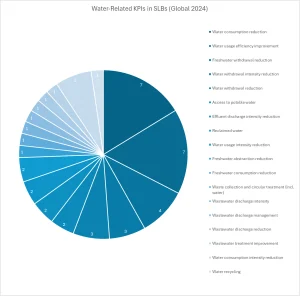

According to the Environmental Finance Database in 2024 there were:

- 43 SLBs valued at nearly USD 72 billion were issued globally with water-related KPIs by corporate borrowers

- The most common KPIs included water consumption reduction, efficiency improvements, and freshwater withdrawal reduction.

While several transactions did not specify precise bond KPIs, SLBs were categorised and grouped based on existing loan KPI details from the Environmental Finance Database and where possible, financing frameworks and other relevant publicly available documents.

Water-Related KPIs in SLBs (Global Issuance, 2024)

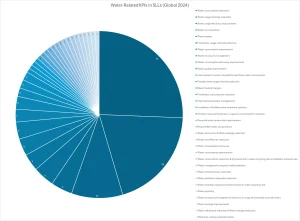

The use of water-related KPIs appeared to be even more prevalent in SLLs, suggesting a stronger link between water management and this approach to sustainability-linked financing.

- 137 SLLs globally included water-related KPIs.

- The total lending volume of these SLLs reached USD 82.0 billion.

Of the one hundred and thirty-seven SLLs tagged by Environmental Finance as having water-related KPIs, only 121 could be categorised.

Water-Related KPIs in SLLs (Global Issuance, 2024)

Water-Related KPIs in the ICMA SLB KPI Registry

The water-related KPIs found in SLBs and SLLs from the Environmental Finance Database align closely with those listed in the ICMA SLB KPI Registry across a wide range of sectors including automotive, construction, energy, food and agriculture, finance, food & beverages, manufacturing, healthcare, maritime, metals & mining, retail, real estate, technology, transportation and utilities.

Across these sectors, water-related KPIs typically fall under six broad categories illustrated in the image below:

Six Categories in the ICMA SLB KPI Registry

These KPIs highlight the capacity for water to be used as a measurable, trackable and financeable resilience theme. However, while these KPIs offer a solid foundation, setting Sustainability Performance Targets (SPTs) against them remains a challenge.

From KPI to Impact: Driving Resilience & Improving Investor Confidence

Although water-related KPIs are common, the next hurdle is setting credible Sustainability Performance Targets (SPTs). SPTs tend to vary widely by issuer, sector and local context, and there is currently no standardised guidance for setting benchmarks or thresholds, especially for SLLs, where SPTs are rarely disclosed. This limits confidence and consistency across the market.

Despite this uncertainty around benchmarking & target-setting, SLBs still offer a powerful mechanism to incentivise financing broader resilience outcomes including water resource management.

The Anthropocene Fixed Income Institute (AFII) in their article ‘Rebuilding Confidence in the UK Water Sector,’ highlight the role SLBs can play in helping embattled UK water companies drive greater transparency on sustainability challenges, while also providing a financial hedge against poor performance for investors. AFII points out that by directly linking the cost of capital to measurable sustainability targets, water companies can improve investor confidence and build accountability.

Looking Ahead

At Cadlas, we are committed to driving innovation in sustainable finance that supports climate adaptation and resilience. One promising pathway lies in strengthening the design of SLBs and SLLs through more robust and relevant target-setting approaches. Developing clearer guidance for setting SPTs for water-related KPIs could be a practical and high-impact next step. This would not only reinforce the resilience link within SLBs and SLLs but also help build issuer and investor confidence in the adaptation value of these instruments.

By addressing these technical and strategic barriers, sustainability-linked finance can evolve into a more powerful mechanism for mobilising private investment in adaptation and resilience efforts. Water-related metrics, in particular, offer a compelling entry point for advancing this agenda. By anchoring SPTs in credible water-related KPIs, issuers can begin to demonstrate how sustainability-linked finance can deliver measurable adaptation outcomes. In doing so, they can help pave the way for wider market recognition of the role SLBs and SLLs can play in scaling climate resilience.

What’s Next?

In Part 2 of this Resilience Unpacked series on sustainability-linked finance, we’ll take a closer look at how water-related KPIs and SPTs are currently used in SLBs and SLLs across different sectors. We’ll examine how these indicators map against industry benchmarks, as well as analyse emerging trends and practices shaping this evolving landscape.

Other Articles