The Role of GSS+ bonds in Mobilising Finance for Adaptation & Resilience

The Need for Adaptation Finance

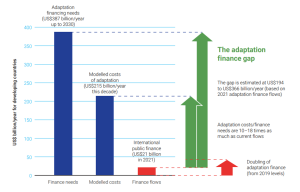

The Climate Policy Initiative (CPI) reports that global climate finance flows surged to nearly $1.3 trillion USD in 2021/2022. This growth was mainly driven by a significant rise in mitigation finance directed towards renewable energy and transport sectors in countries like China, the United States, Europe, Brazil, Japan, and India. Adaptation finance also saw a moderate increase, climbing from $49 billion USD in 2019/2020 to $63 billion USD in 2021/2022.

Adaptation Gap Report 2023 | UNEP – UN Environment Programme

However, despite this encouraging trend, adaptation finance remains just a small fraction of the total global climate finance pie. As climate change becomes increasingly difficult to both mitigate and adapt to, closing the global adaptation finance gap is crucial. CPI estimates that developing countries will need $212 billion USD annually up to 2030 to adapt to the rapidly changing climate, with African countries alone requiring at least USD $52 billion per year until 2030.

This underscores the urgent need for innovative financing instruments to support adaptation efforts. One promising solution is the use of green, social, and sustainability (GSS+) bonds that incorporate adaptation and resilience as eligible uses of proceeds (UoP). This market has seen rapid growth, with over 2500 GSS+ bonds with adaptation issued at a volume of just over USD $1 trillion since Sweden’s City of Gothenburg first included adaptation as an eligible UoP in its 2013 green bond issuance.

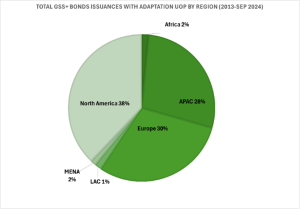

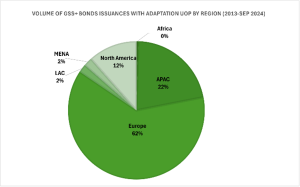

Cadlas recently conducted research into GSS+ bonds with adaptation UoP over the period 2013 to September 2024, using data from the Environmental Finance database. This examined trends in the volume of GSS+ bond issuances as well as the total number of issuances across various issuer types including sovereign, sub-sovereign (agency & municipal), corporates, financial institutions and supranational entities. Below is a brief breakdown of our major findings:

Global Trends

High-Income and Upper-Middle Income Countries:

Issuers in high and upper-middle income countries have mobilized over $620 billion from 1,657 bonds between 2013 and September 2024. Europe leads with over $430 billion from 557 bonds, while the Asia-Pacific (APAC) region follows with just over $110 billion from 383 bonds. North American issuers accounted for approximately 42% of the bonds issued in the region, but only mobilized about $70 billion in total. Municipal entities in the U.S. were responsible for nearly half of the total issuances, although their bond volumes were smaller compared to European sovereign issuances, which made up over 60% of that region’s volume.

Low-Income and Middle-Income Countries

In contrast, low and middle-income issuers have contributed 219 bonds valued at $72 billion. The APAC region stands out, accounting for over 60% of total bonds issued and 55% of the total volume. Latin America and the Caribbean (LAC) followed with nearly 20% of the volume, while Africa accounted for 13% of all issuances but only 4% of the volume, reflecting a predominance of smaller bond issuances in the region.

Regional Trends

APAC:

The APAC region has mobilized over $140 billion from approximately 523 bonds. Countries like Japan, South Korea, Hong Kong, and Australia collectively accounted for nearly 70% of the bond issuances during this period.

Africa:

Africa saw just over $3 billion from 27 bonds, primarily driven by South African financial institutions, which made up 65% of the bond volumes.

Europe:

In Europe, Sweden, the United Kingdom, and France led in the number of bonds issued, with sovereign bonds accounting for 72% of the region’s total volume despite making up only 29% of total issuances.

LAC:

Brazil dominated the LAC region, issuing 10 of the 28 bonds and generating the highest volume, while Colombia followed with 8 sovereign bonds.

MENA:

The MENA region’s landscape included 6 sovereign bonds and 16 issued by financial institutions, with the UAE leading in volume.

North America:

North American bond issuers accounted for approximately 712 bonds, generating over $80 billion in volume. The U.S. dominated in bond issuances, especially among municipal entities.

Conclusion

While adaptation finance still represents a small fraction of global climate finance, the growth of GSS+ bonds signify a positive trend in bridging this adaptation finance gap, particularly in developing countries. As awareness of climate resilience and its importance continues to grow, GSS+ bonds can become a vital instrument in mobilizing in adaptation initiatives.

Other Articles