The Role of GSS+ bonds in Mobilising Finance for Adaptation & Resilience

The Role of GSS+ bonds in Mobilising Finance for Adaptation & Resilience

The Need for Adaptation Finance

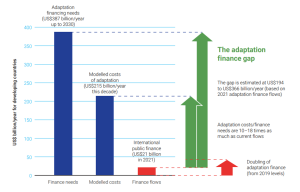

The Climate Policy Initiative (CPI) reports that global climate finance flows surged to nearly $1.3 trillion USD in 2021/2022. This growth was mainly driven by a significant rise in mitigation finance directed towards renewable energy and transport sectors in countries like China, the United States, Europe, Brazil, Japan, and India. Adaptation finance also saw a moderate increase, climbing from $49 billion USD in 2019/2020 to $63 billion USD in 2021/2022.

Adaptation Gap Report 2023 | UNEP – UN Environment Programme

However, despite this encouraging trend, adaptation finance remains just a small fraction of the total global climate finance pie. As climate change becomes increasingly difficult to both mitigate and adapt to, closing the global adaptation finance gap is crucial. CPI estimates that developing countries will need $212 billion USD annually up to 2030 to adapt to the rapidly changing climate, with African countries alone requiring at least USD $52 billion per year until 2030.

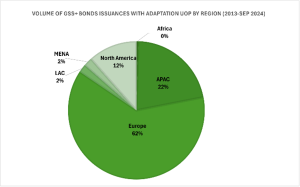

This underscores the urgent need for innovative financing instruments to support adaptation efforts. One promising solution is the use of green, social, and sustainability (GSS+) bonds that incorporate adaptation and resilience as eligible uses of proceeds (UoP). This market has seen rapid growth, with over 2500 GSS+ bonds with adaptation issued at a volume of just over USD $1 trillion since Sweden’s City of Gothenburg first included adaptation as an eligible UoP in its 2013 green bond issuance.

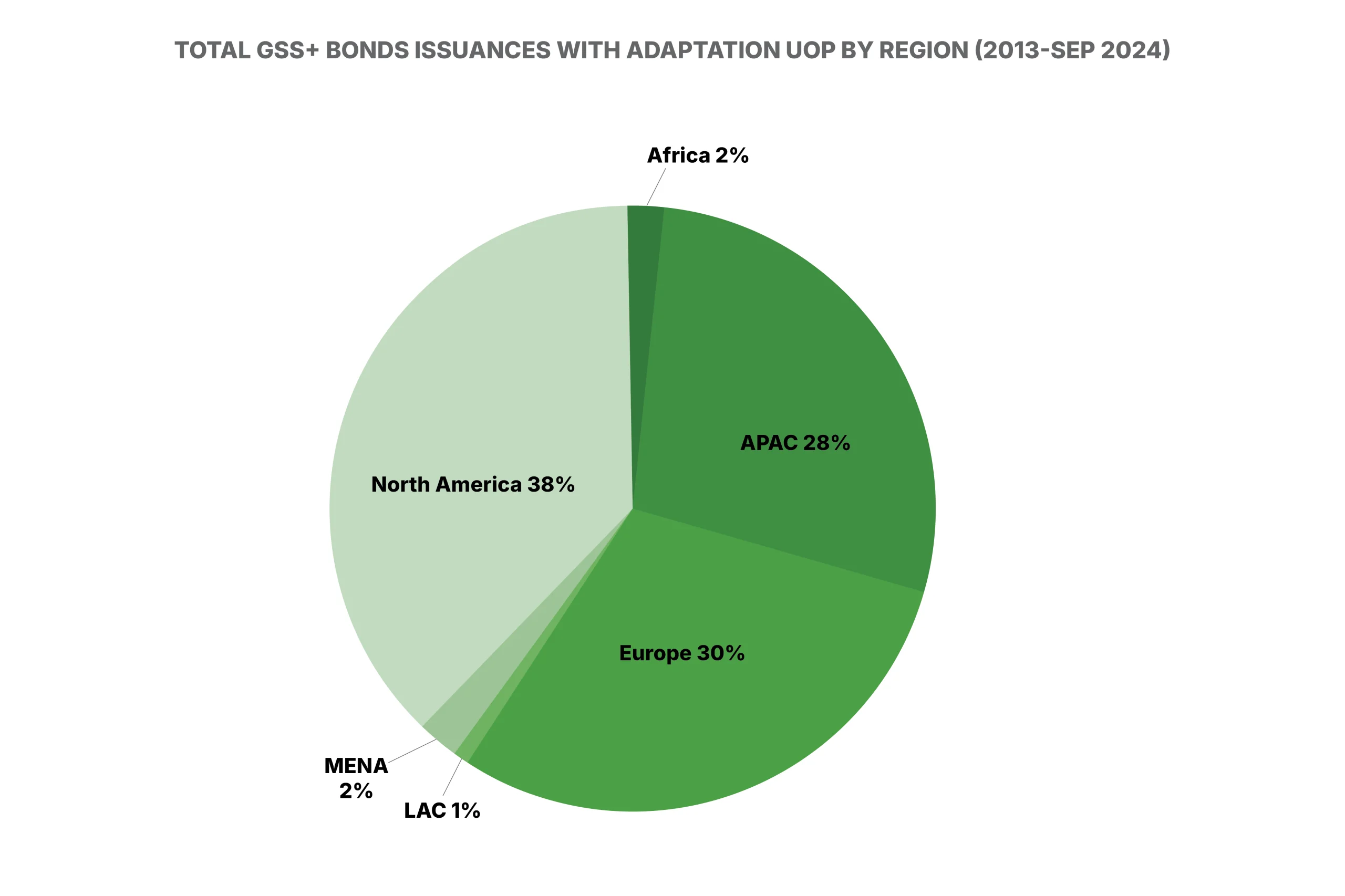

Cadlas recently conducted research into GSS+ bonds with adaptation UoP over the period 2013 to September 2024, using data from the Environmental Finance database. This examined trends in the volume of GSS+ bond issuances as well as the total number of issuances across various issuer types including sovereign, sub-sovereign (agency & municipal), corporates, financial institutions and supranational entities. Below is a brief breakdown of our major findings:

Global Trends

High-Income and Upper-Middle Income Countries:

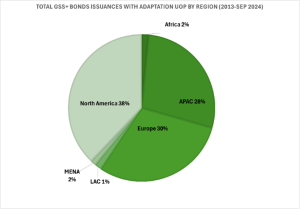

Issuers in high and upper-middle income countries have mobilized over $620 billion from 1,657 bonds between 2013 and September 2024. Europe leads with over $430 billion from 557 bonds, while the Asia-Pacific (APAC) region follows with just over $110 billion from 383 bonds. North American issuers accounted for approximately 42% of the bonds issued in the region, but only mobilized about $70 billion in total. Municipal entities in the U.S. were responsible for nearly half of the total issuances, although their bond volumes were smaller compared to European sovereign issuances, which made up over 60% of that region’s volume.

Low-Income and Middle-Income Countries

In contrast, low and middle-income issuers have contributed 219 bonds valued at $72 billion. The APAC region stands out, accounting for over 60% of total bonds issued and 55% of the total volume. Latin America and the Caribbean (LAC) followed with nearly 20% of the volume, while Africa accounted for 13% of all issuances but only 4% of the volume, reflecting a predominance of smaller bond issuances in the region.

Regional Trends

APAC:

The APAC region has mobilized over $140 billion from approximately 523 bonds. Countries like Japan, South Korea, Hong Kong, and Australia collectively accounted for nearly 70% of the bond issuances during this period.

Africa:

Africa saw just over $3 billion from 27 bonds, primarily driven by South African financial institutions, which made up 65% of the bond volumes.

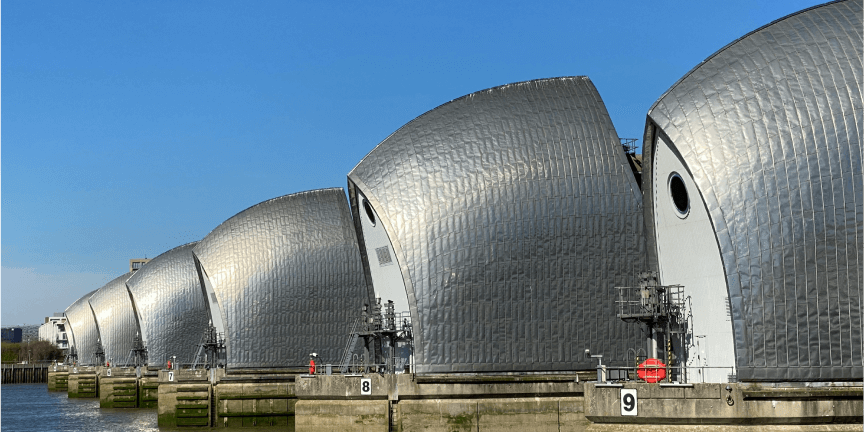

Europe:

In Europe, Sweden, the United Kingdom, and France led in the number of bonds issued, with sovereign bonds accounting for 72% of the region’s total volume despite making up only 29% of total issuances.

LAC:

Brazil dominated the LAC region, issuing 10 of the 28 bonds and generating the highest volume, while Colombia followed with 8 sovereign bonds.

MENA:

The MENA region’s landscape included 6 sovereign bonds and 16 issued by financial institutions, with the UAE leading in volume.

North America:

North American bond issuers accounted for approximately 712 bonds, generating over $80 billion in volume. The U.S. dominated in bond issuances, especially among municipal entities.

Conclusion

While adaptation finance still represents a small fraction of global climate finance, the growth of GSS+ bonds signify a positive trend in bridging this adaptation finance gap, particularly in developing countries. As awareness of climate resilience and its importance continues to grow, GSS+ bonds can become a vital instrument in mobilizing in adaptation initiatives.

Other Articles

Insights from Climate Bonds CONNECT 2024: Fostering Resilience in a Changing World

Insights from Climate Bonds CONNECT 2024: Fostering Resilience in a Changing World

From discussions about transition planning for corporates to the path to achieving interoperability and innovative models for scaling up finance for resilience, Climate Bonds CONNECT 2024 was filled with valuable insights and impactful discussion sessions around adaptation and resilience.

The jam-packed day began with Climate Bonds Initiative (CBI) CEO, Sean Kidney’s opening speech where he emphasized the need for global effort on building resilience to climate change given that it is a global challenge.Furthermore, efforts to avoid catastrophic climate change continue to be hindered by a range of crises, including socioeconomic inequality, health and food security concerns, all of which are exacerbated by climate change itself. These challenges require international cooperation and coordination, particularly around adaptation and resilience.

Mr. Kidney underscored this point by noting that climate change will adversely impact the planet irrespective of global progress on mitigation/decarbonisation. As a result, it is necessary now, more than ever to scale up action on adaptation and resilience. While the challenges around decarbonisation/mitigation are well documented this is not the case for resilience/adaptation. However, he noted that tools like CBI’s recently launched Climate Bonds Resilience Taxonomy, for which Cadlas served as the lead technical partner, provide important guidance and clarity on a range of urgent priorities for building resilience. In closing out his speech Mr. Kidney said that despite the enormity of the challenges surrounding climate change, he is still hopeful that we can work together to find a solution. He pointed out that “we are a hive species” intimating our need to work collectively to solve global challenges and cited the ‘green revolution’ and the role of technology as great opportunities.

Immediately following Mr. Kidney’s speech was Torsten Albrecht, Principal Investment Officer at the Asian Infrastructure Investment Bank (AIIB), who spoke about AIIB and the role of multilateral development banks (MDBs) in supporting the green, social and sustainable (GSS+) bonds market, particularly in emerging economies. He highlighted AIIB’s goal to achieve sustainable economic development through infrastructural projects and the bank’s work to actively scale up private sector participation in climate focused projects. Mr. Albrecht noted that despite the encouraging growth of the GSS+ bonds market in developed markets, there is still a sizeable finance gap and more focus should be placed on emerging markets to help close this gap. This was followed by session 1, a panel discussion on opportunities for corporates and countries around transition planning.

After a brief networking and coffee break, attendees were back in the plenary for session 2 on interoperability between taxonomies which was moderated by CBI’s Director of Thought Leadership, Anna Creed. There are over 45 national or regional taxonomies in existence across the globe, with more in development. While this is necessary given the range of geographical contexts and differing levels of development, it presents a significant reporting challenge to investors and regulators. Panellists highlighted the need for and importance of comparability, equivalence and disclosures in achieving interoperability between taxonomies. Following this was a networking lunch which preceded the second 5-minute OnSwitch session on the Asian Development Bank’s work in the GSS+ bonds market in Southeast Asia.

Immediately after this was what CEO Sean Kidney pointedly referred to as the most highly anticipated session of the day. Session 3 was entitled ‘Innovating for Resilience: Scaling-up Proven Models to Catalyze the $3 Trillion Opportunity’ and was moderated by CBI’s Director of Strategic Programmes, Ujala Qadir. Before jumping into the discussion, Ms. Qadir asked panellists to share how climate change has personally impacted their lives within the last year. Several panellists spoke about their experiences with increased rainfall, flooding, extreme heat, landslides and hurricanes which set the tone for the panel discussion and underscored the importance of adaptation and resilience. She noted that we already have solutions and the capital, but they needed to be repackaged to direct finance towards adaptation and resilience. Panellist Gerald Evelyn, Invesco’s Senior Client Portfolio Manager, cited the use of blended finance in driving institutional investment towards building resilience in the world’s most climate vulnerable regions. He noted that there has been significant interest from institutional investors in Invesco’s Climate Adaptation Action Fund.

Lasitha Perera, the co-founder and CEO of the Development Guarantee Group, also highlighted the usefulness and opportunity guarantees provide, pointing out that “guarantees have mobilised the most private capital but are the most underused.” He noted that many adaptation and resilience investments, especially in emerging markets, sit in sub-investment grade countries. While simultaneously instilling confidence in investors, guarantees provide access to private finance for investees and countries that are often excluded because traditional institutional investors rely on ratings as an indicator of risk. The conversation then continued to the role of MDBs in scaling up finance for adaptation and resilience in which Xianfu Lu, Consultant on Adaptation and Climate Resilience at AIIB, noted that the capital is already there and MDBs already have several processes in place to track adaptation finance, but these efforts are hindered by a lack of “good projects in the pipeline.” In agreement with Ms. Lu, British International Investment (BII) Managing Director of Climate, Diversity and Advisory, Amal-Lee Amin, pointed out that while development finance institutions (DFIs) and MDBs can help build out the pipeline, governments needed to work on creating ‘enabling environments’ for project development. She also noted the importance of collaboration in managing risk and building capacity to scale up finance for resilience. Panellists also spoke about the importance of metrics for helping investors to understand and gain greater transparency around resilience issues and needs. In concluding the session, Ujala Qadir cited the usefulness of the Climate Bonds Resilience Taxonomy in helping investors to understand the impact of their investments on building resilience.

Lasitha Perera, the co-founder and CEO of the Development Guarantee Group, also highlighted the usefulness and opportunity guarantees provide, pointing out that “guarantees have mobilised the most private capital but are the most underused.” He noted that many adaptation and resilience investments, especially in emerging markets, sit in sub-investment grade countries. While simultaneously instilling confidence in investors, guarantees provide access to private finance for investees and countries that are often excluded because traditional institutional investors rely on ratings as an indicator of risk. The conversation then continued to the role of MDBs in scaling up finance for adaptation and resilience in which Xianfu Lu, Consultant on Adaptation and Climate Resilience at AIIB, noted that the capital is already there and MDBs already have several processes in place to track adaptation finance, but these efforts are hindered by a lack of “good projects in the pipeline.” In agreement with Ms. Lu, British International Investment (BII) Managing Director of Climate, Diversity and Advisory, Amal-Lee Amin, pointed out that while development finance institutions (DFIs) and MDBs can help build out the pipeline, governments needed to work on creating ‘enabling environments’ for project development. She also noted the importance of collaboration in managing risk and building capacity to scale up finance for resilience. Panellists also spoke about the importance of metrics for helping investors to understand and gain greater transparency around resilience issues and needs. In concluding the session, Ujala Qadir cited the usefulness of the Climate Bonds Resilience Taxonomy in helping investors to understand the impact of their investments on building resilience.

After this, the day continued with even more insightful sessions on the role of finance in advancing sustainable agriculture, the use of sustainable land bonds to finance nature-based carbon capture and storage as well as transparency and reporting in the GSS+ bonds market. In his spirited closing remarks, Sean Kidney invited attendees to share their own reflections on the day’s discussions and reiterated his hopefulness and excitement for the future.

Other Articles

Cadlas Newsletter: October 2024 Issue

Welcome to the Cadlas Newsletter!

Welcome to the first edition of the Cadlas Quarterly Newsletter! Each edition will provide valuable insights into the latest trends and developments in climate resilience finance, covering topics such as sustainable bonds, climate resilience taxonomies, and more. This newsletter is also an excellent way to stay up-to-date on the Cadlas team and our work!

The Launch of the Climate Bonds Resilience Taxonomy

The launch of the Climate Bonds Resilience Taxonomy (CBRT) in September 2024 marks a significant advancement in climate resilience financing.

This initiative provides a clear vocabulary for these investments, fostering collaboration among investors, issuers, regulators, and policymakers.

The CBRT builds upon Climate Bonds’ extensive experience of taxonomy development and extends their existing Climate Bonds Taxonomy into the increasingly urgent, but comparatively under-funded, area of climate resilience.

Cadlas is proud to be the Lead Technical Partner on this ground-breaking initiative, having worked closely with Climate Bonds since 2022 to bring in our extensive, practical experience of climate resilience financing.

Climate Resilience and Sustainable Industrial Development: UNIDO’s Climate Adaptation Week

Cadlas CEO Craig Davies shared Cadlas’ perspectives on the role of the financial sector in supporting private sector action on climate adaptation as part of a Climate Adaptation Week organised by the United Nations Industrial Development Organisation (UNIDO) on 14-15 October. Building climate resilience is absolutely central to UNIDO’s core mission of inclusive and sustainable industrial development.

In addition to securing its own climate resilience, the industrial base also has a vital role to play in delivering the solutions and innovation that is urgently needed to build a climate-resilient economy at scale.

Cadlas Participation in the ADB CAIP Forum

Cadlas recently made significant contributions to the Asian Development Bank‘s Climate Adaptation Investment (CAIP) Forum in Manila, connected to our ongoing work with the ADB on this topic. Our Senior Specialist in Climate Resilience, Noah Wescombe, delivered a key presentation on climate resilience bonds, showcasing Cadlas’s role as the Lead Technical Partner in developing the Climate Bonds Resilience Taxonomy. This presentation marked a crucial step in connecting climate adaptation to tangible investment modalities, generating substantial interest among forum attendees.

In addition to presenting, Cadlas actively participated in technical discussions and led an investment planning clinic with the representatives of national Armenian delegations. This engagement provided valuable insights into structuring sustainability-linked loans and highlighted the necessary enabling environments for scaling such products. Cadlas’s involvement underscored our expertise in climate resilience financing and our commitment to advancing practical solutions for adaptation investments across diverse national contexts.

Cadlas Supports the GEF’s Climate Adaptation Innovation & Learning Project on Climate Change Adaptation Information Flows for the Financial Sector

The financial sector needs improved information on climate change adaptation to direct funds toward investments that enhance the real economy’s climate resilience.

Cadlas is delighted to be working alongside an impressive array of partner organisations including UNEP-FI, UNIDO, Climate-KIC and the Global Adaptation and Resilience Investment (GARI) group to implement this important GEF project. In particular, Cadlas is providing technical support to UNEP-FI on climate change adaptation impact measurement and information flows over 2024-25.

From the Insights Blog:

From discussions about transition planning to the challenges with achieving interoperability between taxonomies and innovative models for scaling up finance for resilience, Climate Bonds CONNECT 2024 was filled with valuable insights and impactful discussion sessions around adaptation and resilience.

From discussions about transition planning to the challenges with achieving interoperability between taxonomies and innovative models for scaling up finance for resilience, Climate Bonds CONNECT 2024 was filled with valuable insights and impactful discussion sessions around adaptation and resilience.

Cadlas in the News:

In a recent interview with Environmental Finance, Cadlas CEO Craig Davies highlighted that while interest and momentum around adaptation-themed sustainable bonds is growing, significant investment opportunities are still being overlooked. Despite a substantial increase in bond issuances in recent years, actual allocations to adaptation and resilience investments remain low. In particular, he pointed out an almost pervasive misalignment between adaptation strategies and eligible investments at the sub-sovereign level within sustainable bond frameworks.

As investors continue to recognize the revenue-generating potential of these investments, Davies emphasized the need for a clear taxonomy to enhance market understanding of adaptation and resilience.

Cadlas CEO, Craig Davies, recently joined the Climate Proof podcast to discuss the current state of financial regulation related specifically to adaptation and whether targeted regulatory development could potentially help mobilities capital for adaptation.

Within the last decade, financial regulators across the globe have begun to enforce mandatory climate-related disclosures on companies and financial institutions including rules on “green funds” labelling. However, despite this increased regulatory action, adaptation and resilience have been largely neglected.

Find Us Here

Cadlas will be attending the Climate Financial Risk Forum (CFRF) adaptation working group launch in November 2024

Unlocking the potential of sustainable bonds for financing climate resilience: the Climate Bonds Resilience Taxonomy

Unlocking the potential of sustainable bonds for financing climate resilience: the Climate Bonds Resilience Taxonomy

Today has seen the launch of the Climate Bonds Resilience Taxonomy (CBRT) during New York Climate Week. This exciting development offers the potential to scale up market action on financing climate resilience (also referred to as adaptation) by providing clear and consistent definitions of climate resilience investments – in other words, a common vocabulary for climate resilience financing that can be used by broad range of stakeholders including investors, issuers, regulators and policymakers.

The CBRT builds upon Climate Bonds’ extensive experience of taxonomy development and extends their existing Climate Bonds Taxonomy into the increasingly urgent, but comparatively under-funded, area of climate resilience. Cadlas is pleased to be the Lead Technical Partner on this ground-breaking initiative, having worked closely with Climate Bonds since 2022 to bring in our extensive, practical experience of climate resilience financing.

The sustainable bonds market represents a significant source of financing for sustainable development, with total sustainable bond issuances now exceeding USD 5 trillion. However, only a small fraction of the capital raised through these issuances currently addresses climate resilience. While Climate Bonds’ analysis suggests that around 19% of labelled green bond issuances include climate resilience (or adaptation) as an eligible use of proceeds (UoP), evidence suggests that only a small fraction of this financing is being challenged into climate resilience investments.

Nonetheless, sustainable bonds are potentially a key instrument for mobilizing investment in climate resilience. Since the City of Gothenburg first included adaptation as an eligible UoP in its 2013 green bond issuance, market activity has progressively increased so that today around 2,500 sustainable bonds issuances have included adaptation as an eligible UoP, while a total volume of just over USD 1 trillion. While most of this activity has taken place in Europe, North America and the Asia-Pacific (APAC) region, there is a need for greater action in Africa, Latin America & the Caribbean (LAC), and the Middle East & North Africa (MENA) regions, where sustainable bond volumes with adaptation UoP remain relatively low despite these being some of the most climate-vulnerable regions of the world with significant climate resilience investment needs.

This highlights the need for much greater flows of financing for climate resilience, as the frequency and severity of climate change impacts – and their economic and human costs – continue to accelerate. For example, the United Nations estimates that developing countries need up to 18 times more adaptation finance than is currently provided. Furthermore, at present more than 98% of reported adaptation finance is provided by public institutions such as development finance institutions (DFIs), which highlights the need for much greater action on mobilising private finance for climate resilience.

An important obstacle to private finance mobilisation for climate resilience has been a lack of clarity on definitions and criteria for climate resilience investments. This creates uncertainty for both investors and issuers and hinders the flow of capital. While sustainable finance taxonomies can play an important role in directing private and public investments toward sustainability goals, they have hitherto not given due attention to climate resilience as an investment theme.

To date, climate resilience has tended to take a back seat to climate mitigation (or decarbonisation) objectives in sustainable finance taxonomies, with a lack of consistency in the sectoral coverage and breakdown of climate resilience financing. This has been compounded by process-based definitions that are difficult for users to apply, and a lack of clear eligibility criteria for determining whether an investment is meaningfully contributing to climate resilience.

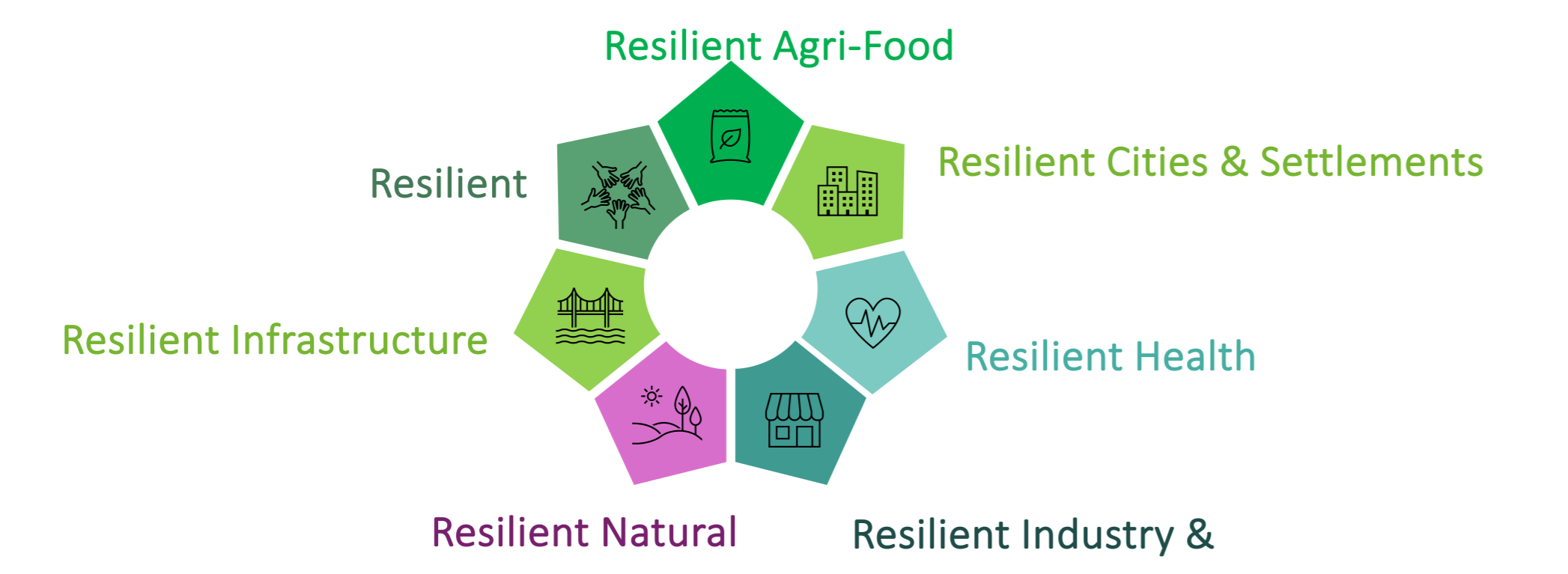

The CBRT directly addresses these challenges by providing a credible classification system for climate resilience investments. It offers focused, detailed guidance on climate resilience, an area often under-prioritised or addressed only broadly in many existing taxonomies. The CBRT provides clear, consistent and comprehensive coverage of climate resilience investments based on six Climate Resilience Themes. This covers a broad range of investment types ranging from financing the adoption of specific climate resilience measures within investments to financing economic activities that provide A&R solutions.

The CBRT fills a critical market need for a common foundation that helps investors identify and scale up finance for a wide range of investments that genuinely contribute to building climate resilience. It addresses three critical gaps:

- Clear, Science-Based Definitions and Criteria: The CBRT provides clear, science-based definitions and criteria for identifying investments that substantially contribute to climate resilience. This is essential for overcoming the lack of clarity that has hindered resilience finance flows to date.

- Navigating the Regulatory Landscape: The CBRT helps investors and companies navigate the evolving regulatory landscape. It aligns with and advances beyond regulatory standards like the EU Sustainable Finance Taxonomy, providing a rigorous, globally applicable framework for demonstrating the climate resilience credentials of investments.

- Flexibility and Adaptability: The CBRT has been designed to be flexible and adaptable to diverse country contexts and investor needs. This is crucial for building resilience, which requires tailored approaches that reflect local vulnerabilities and priorities. The format of the CBRT also allows for further improvements and tailoring to be added over time.

The next exciting chapter in the CBRT story begins now, as it begins to be taken up and put to use by issuers, investors, regulators, policymakers and others. The CBRT will not only enhance transparency for investors by eliminating certain information asymmetries but also support the alignment of global capital flows with local resilience needs and opportunities underpinned by rigorous, science-based eligibility criteria.

As Cadlas continues to collaborate with partners across the finance landscape to enhance resilience financing in various country contexts and investor mandates, we are confident in the CBRT’s applicability across multiple use cases – particularly as it relates to the sustainable debt market. By supporting a range of issuers, investors and other participants in applying and using the CBRT, we can enhance the effectiveness and impact of climate resilience investments, driving more capital towards projects that are crucial for adapting to and mitigating the effects of climate change.

Cadlas is committed to fostering a resilient future by enabling more informed and impactful investments in climate adaptation and resilience. Stay tuned for more updates on how the CBRT is set to transform the landscape of climate finance.

Other Articles

Basing investment decisions on climate adaptation and resilience impact

Basing investment decisions on climate adaptation and resilience impact

As investors become increasingly aware of the implications of our changing climate, there is a growing need for more information about the positive adaptation & resilience impacts of investments.

Private investors are increasingly aware of emerging investment opportunities in adaptation & resilience, with the Bank of America forecasting that the global market for adaptation & resilience may reach USD 2 trillion by the middle of this decade, and MSCI estimating that 11% of publicly listed companies deliver products and services that contribute towards adaptation & resilience.

Information about the positive adaptation & resilience impacts of investments can help to engage private investors and mobilise finance for urgently needed investments in adaptation & resilience.

But private investment in adaptation & resilience is held back by a lack of clear, practical and investor-relevant adaptation & resilience metrics that investors can use to identify, appraise and prioritise investments that make meaningful contributions towards adaptation & resilience.

Therefore Cadlas is pleased to have worked with the Adaptation & Resilience Investors Collaborative (ARIC) and the United Nations Environment Programme Finance Initiative (UNEP-FI) to develop guidance for investors on the assessment of adaptation and resilience impact in private investments. This guidance, which is available here, sets out a practical framework for assessing adaptation and resilience impact across a broad range of investments using a set of clear, consistent and investor-relevant metrics.

Other Articles

Assessing adaptation & resilience impact in private investments: new guidance for investors

Assessing adaptation & resilience impact in private investments: new guidance for investors

Cadlas is pleased to have provided technical support to the Adaptation & Resilience Investors Collaborative (ARIC) for the development of a framework for assessing the positive impact of private investments towards climate adaptation and climate resilience goals.

This leverages the experience of impact investing to set out a clear framework to help investors measure and manage the way that their investments contribute towards adaptation and resilience.

As private investors become more aware of the scope for investment in adaptation & resilience interventions and solutions, there is an increasing need for meaningful and consistent information about the positive contributions of those investments towards the climate resilience of people, the planet and the economy.

For further details, read the full report which is available on the ARIC webpage: Adaptation & Resilience Impact: A measurement framework for investors

Other Articles

Internship: Climate Resilience Financing

Internship: Climate Resilience Financing

ABOUT CADLAS

Cadlas is a dynamic start-up advisory practice focused on the rapidly expanding field of climate resilience financing. Our mission is to help build a climate resilient future, by helping capital to flow towards activities, assets and technologies that build resilience to the impacts of a changing and more variable climate.

We advise businesses, financial institutions, investors, markets, regulators, policymakers and international organisations on climate resilience analytics, definitions and mechanisms, on climate resilience impact and strategy, and on the evolving regulatory landscape. Our work ranges from bond markets and impact investing, to investment strategy and financial supervision, and beyond.

Climate resilience (or adaptation) financing is vitally important and yet currently under-developed area of sustainable finance. At Cadlas we focus on impactful, practical, and market-relevant approaches to problem-solving and innovation in this area.

ABOUT THE ROLE

This is a unique and outstanding opportunity for a recent graduate candidate looking for an entry-point and exposure to the field of climate resilience & adaptation financing.

• You’ll have a passion for climate resilience, climate action and sustainability, and a solid understanding of climate change impacts and their significance for economic activity and financial markets.

• You’ll be comfortable working in a dynamic, fast-paced environment with the ability to deliver work to tight timelines.

• You’ll be resourceful, a quick learner with a good eye for detail, able to take initiative and work both independently and as part of a team and have excellent communication skills.

• You’ll be hardworking and committed to delivering work to a high standard.

You will work in a small and dedicated team that leads on innovative approaches to scaling up the quantity and quality of climate resilience & adaptation financing, working alongside a broad range of stakeholders across the climate science community and the financial sector. This is a unique opportunity to be involved in projects that have a significant impact on how private finance is mobilised towards climate resilience & adaptation internationally. You will also have the opportunity to build your network in a specialised and technical area of climate finance.

WHAT YOU'LL BE DOING

As an intern at our company, you will gain valuable hands-on experience over six months supporting client projects and research. Key responsibilities include:

• Conducting research and analysis on climate physical risk and resilience/adaptation topics to inform our work. This may include:

• Researching integration of climate resilience & adaptation criteria and objectives into target-setting and investment decisions in the financial industry, particularly in the context of the climate strategies of private financial institutions.

• Synthesizing lessons from development finance on effective mobilization of climate resilience & adaptation finance in lower-income countries, including useful case-studies that illustrate them.

• Analysing gaps and opportunities for multilateral banks and climate funds to increase support for climate resilience & adaptation finance.

• Tracking approaches to physical climate risk integration into climate resilience & adaptation planning at different market levels and sectors.

• Assisting with report writing and presentation development

• Gathering and organizing new data in spreadsheets and databases, including creation of data visualizations and summaries where relevant

• Learning about our consulting processes and methodologies, and how they can vary dynamically across our clients

• Thinking creatively about solutions to climate resilience & adaptation finance problems and brainstorming with the team where opportunities arise.

This internship will provide you with practical experience in sustainability consulting and the opportunity to apply your academic knowledge, collaborating with members of our team.

WHAT YOU'LL BRING

• Passion for environmental issues and sustainability

• Strong analytical and critical thinking skills

• Proficiency in Microsoft Office applications, especially Excel

• Excellent written and verbal communication abilities

• Detail-oriented with good organizational skills

• Some coding experience (e.g. python, JS) and/or basic proficiency with relevant software (e.g. GIS) would be a plus

• Previous internship experience in a related field would be a plus

As an intern, you will gain valuable experience to complement your graduate studies. This is an excellent way to expand your knowledge and jumpstart your career in sustainability.

To be successful you will need to be highly detail-orientated and able to produce high-quality outputs, take initiative to solve problems and be comfortable with a fast-paced start up environment.

Internship: Climate Resilience Financing

LOCATION

Hybrid (remote working / Cardiff office)

START DATE

As soon as possible

ROLE

Six month fixed-term contract

SALARY

£28,000 (pro-rata over six months)

LOCATION

Cardiff / flexible hybrid working

REPORTING TO

CEO

SALARY

from £30,000 to £35,000 depending on skills and experience

APPLICATION DEADLINE

1 March 2024

To apply – please submit your CV and a short cover letter (of no more than two sides) to [email protected]

Your cover letter should include details of:

• your relevant work / educational experience.

• your skills and in particular your experience in undertaking research tasks, conducting analysis, writing reports and/or briefings.

• how you meet the broader requirements of the role.

CVs without a cover letter will not be considered.

The closing date for applications is 9am UK time on 1 March 2024.

Please note:

• If you do not already hold the right to work in the UK and/or require sponsorship in order to continue working here, you should think carefully before applying. Unfortunately, Cadlas cannot guarantee visa sponsorship to candidates for this position.

• Cadlas is an equal opportunity employer and we value diversity. If you are invited to interview and need any reasonable adjustments during the interview process, please let us know.

Analyst: Climate Resilience

Analyst: Climate Resilience

WHO WE ARE

Cadlas is a dynamic start-up advisory practice focused on the rapidly expanding field of climate resilience financing. Our mission is to help build a climate resilient future, by helping capital to flow towards activities, assets and technologies that build resilience to the impacts of a changing and more variable climate.

We advise businesses, financial institutions, investors, markets, regulators, policymakers and international organisations on climate resilience analytics, definitions and mechanisms, on climate resilience impact and strategy, and on the evolving regulatory landscape. Our work ranges from bond markets and impact investing, to investment strategy and financial supervision, and beyond.

WHO WE'RE LOOKING FOR

This is an outstanding opportunity for a postgraduate candidate wishing to gain experience and pursue professional development in the field of climate and sustainable finance.

• You’ll have a passion for climate resilience, climate action and sustainability, and a solid understanding of climate change impacts and their significance for economic activity and financial markets.

• You’ll be comfortable working in a dynamic, fast-paced environment with the ability to handle multiple assignments at once.

• You’ll be resourceful, a quick learner with a good eye for detail, able to take initiative and work both independently and as part of a team, and have excellent communication skills.

• You’ll be hardworking, loyal and committed to delivering work to a high standard.

WHAT YOU'LL BE DOING

The successful candidate will be involved in supporting the design and delivery of an exciting range of client assignments, as well as contributing to wider research and analytics.

• Providing technical input and analysis

• Producing data analysis and concise report writing

• Conducting research into topics of emerging interest

• Preparing and managing spreadsheets, databases, and analytical tools

• Contributing towards reports, presentations and analytical products

• Managing tasks to time while ensuring high quality

WHAT YOU'LL BRING

• A Master’s degree or equivalent in a relevant topic such as climate change, environmental science or engineering, finance, business or other relevant field

• Passion for and deep understanding of climate change issues, especially climate change impacts, climate resilience / adaptation, and implications for business, finance and economic activity

• Ideally one or two years’ professional working experience in a relevant capacity and/or organisation

• Experience of project management, with an organised and methodological approach to planning and delivering work of a high quality

• Excellent self-motivation, a can-do attitude, and ability to work effectively both independently and as part of a team

• A high level of accuracy and attention to detail, along with the ability to deliver high quality of reports and presentations

• Excellent verbal and written English communication skills, with other language skills considered as a very welcome plus

• Competent user of Microsoft Office, including Word, PowerPoint and especially Excel. Additional IT skills such as database design/manipulation, coding, artificial intelligence, etc. will be considered an advantage.

WHAT WE OFFER

This is an initial one year contract offer, with the potential for extension and career progression possibilities for the right candidate and subject to performance, as part of a fast-growing start up firm in a dynamic and fast-evolving business area.

• A varied and autonomous job in a dynamic, growing start-up

• An exciting, flexible and multicultural working environment

• A supportive and enabling corporate culture with a flat hierarchy

• Career progression opportunities including potential management roles for the right candidates, subject to performance

• Active work-life balance through flexible working hours, various working time models and mobile working

• Competitive salary range

Cadlas is a firm advocate of a flexible working arrangements, which allow our team members to perform their roles and make their contributions in the way that works best for each of them. While you will be expected to spend some time working in in our central Cardiff office, we encourage a flexible hybrid mix of office-based working, home working and other remote working, which can be tailored to individual needs.

Cadlas ensures that all of our colleagues, future colleagues, and applicants, as well as our clients and other partners, are all treated equally regardless of age, gender, marital or civil partnership status, colour, ethnic or national origin, culture, religious belief, philosophical belief, political opinion, disability, gender identity, gender expression or sexual orientation.

Analyst: Climate Resilience

LOCATION

Cardiff / flexible hybrid working

REPORTING TO

CEO

SALARY

from £30,000 to £35,000 depending on skills and experience

LOCATION

Cardiff / flexible hybrid working

REPORTING TO

CEO

SALARY

from £30,000 to £35,000 depending on skills and experience

If you are interested and would like to join us, please email [email protected] with your curriculum vitae and covering letter, stating the earliest possible starting date and confirming that you have the right to work in the UK. Applications should be received by Monday 27 November.

Once you have submitted your application we will be in touch. Please be aware that the timing can vary dependent on the volume of applications that we receive for each role. Shortlisted candidates will be invited for an interview and may be requested to provide samples of written or other relevant work.

Measuring impact for scaling up investment in climate resilience

Measuring impact for scaling up investment in climate resilience

Investors need clear, consistent and comparable information about the impact of their investments in order to allocate capital towards effective climate resilience responses and solutions. Cadlas is pleased to be working with the Adaptation and Resilience Investor Collaborative (ARIC) and the United Nations Environment Programme Finance Initiative (UNEP-FI) in an important initiative to advance the measurement of climate resilience impact.

Further details available here.

Other Articles

Cadlas collaborates with Climate Bonds on the Development of a Climate Resilience Taxonomy for Sustainable Bonds

Cadlas collaborates with Climate Bonds on the Development of a Climate Resilience Taxonomy for Sustainable Bonds

As the impacts of climate change become more evident and increasingly material for governments and companies alike, the need to identify and scale up sources of finance for investment in climate resilience becomes ever more pressing.

Green, social, sustainable and sustainability-linked (GSS+) bonds offer huge potential for accessing capital markets for scaling up urgently needed investment in climate resilience. The USD 3.7 trillion GSS+ debt market enables projects and entities such as corporates, sovereign and sub-sovereigns to access finance for sustainable investments in support of the low-carbon transition, social objectives or other sustainability themes – including climate resilience.

Climate resilience already features in GSS+ bonds, with 19% of GSS+ debt instruments having some degree of climate resilience UoP. Recent examples of issuances covering climate resilience include New Zealand’s sovereign green bond and the Arizona Industrial Development Authority’s sustainability-linked bond. In addition, dedicated climate resilience (or climate adaptation) bonds have been issued by the EBRD (2019) and the AIIB (2023).

However, in order to realise the potential of GSS+ debt instruments for financing climate resilience, a clear and systematic framework for issuers and investors is required. This is why Cadlas is pleased to have supported Climate Bonds on the first phase of the development of their Climate Resilience Taxonomy for sustainable bonds. The Climate Bonds Climate Resilience Taxonomy White Paper sets out a clear, upstream framework for defining climate resilience investments that may be eligible for GSS+ bond issuances oriented towards climate resilience.

The White Paper identifies seven ‘climate resilience themes’, covering resilient agri-food systems, resilient cities, resilient health, resilient industry and commerce, resilience infrastructure, resilient nature and biodiversity, and resilient societies. Across those themes, investments may be categorised according to the level of assessment that they require – enabling those investments with clear climate resilience benefits and low risk of significant harm to other sustainability objectives to move ahead more quickly.

Establishing a common language for issuers, investors and other stakeholders to use will be instrumental for harnessing the potential of GSS+ debt instruments for financing climate resilience. The White Paper lays out a solid foundation for the further development of this work over the next few years.

Other Articles