The Launch of the Adaptation and Resilience Impact Measurement Toolkit

The Launch of the Adaptation and Resilience Impact Measurement Toolkit

Over the past year, Cadlas has worked closely with UNEP FI under the Climate Adaptation Innovation and Learning (CAIL) project’s Community of Practice on Climate Change Adaptation Impact Measurement and Information Flows (CoP4), exploring how information about climate adaptation and resilience (A&R) can be used by financial institutions.

An important message emerged from the extensive consultations with the broad range of financial institutions that make up CoP4: making the business case for scaling adaptation finance is more difficult when financial institutions cannot reliably measure or demonstrate the A&R impact of their financing activities.

When the benefits of A&R investments are not visible or verifiable, institutions struggle to build credible business cases for allocating capital to A&R. As a result, climate-vulnerable communities and sectors often remain unable to access the resources they need. Without systematic measurement, it is also harder to identify which interventions genuinely build resilience and which do not.

This Toolkit addresses this gap by providing a structured approach for assessing, tracking and communicating A&R impact. In response to this clearly identified need, over 2025 a collaborative effort between Cadlas, UNEP-FI and the CoP4 members has culminated in the development of the Adaptation and Resilience Impact Measurement Toolkit

Cadlas is proud to have contributed the technical inputs that shaped this Toolkit.

Drawing on our expertise in A&R impact measurement, we have helped to ensure that the Toolkit provides practical, decision-useful guidance that supports financial institutions in generating credible evidence of A&R outcomes and in integrating physical climate risk into financing strategies.

This forms an important part of our broader work here at Cadlas to help financial institutions embed A&R into their operations, pursue the opportunities associated with A&R as an emerging investment them, and scale up urgently needed finance for A&R.

The Measurement Challenge

As Cadlas has observed through our work with our financial sector clients, partners and stakeholders, A&R can be challenging for financial institutions to measure. A&R benefits can vary significantly across geographies, sectors and communities. Data in climate-vulnerable regions is sometimes limited, and it can often be difficult to establish counterfactuals against which A&R impact can be measured. Many A&R benefits unfold slowly, sometimes over decades, while financial institutions typically operate on much shorter investment and reporting cycles.

Together, these factors create an A&R measurement gap that constrains capital flows and contributes to the persistent under-valuing and under-scaling of A&R finance, even as climate impacts intensify. The Toolkit does not aim to eliminate these challenges entirely, but provides a practical framework that enables institutions to generate credible evidence of A&R benefits that is proportionate to their capabilities and decision needs.

The Toolkit is intended for to be used by a broad range of financial institutions including commercial banks, development finance institutions, insurers and reinsurers, and asset managers. It recognises that each institution type has different motivations, operational models and financial decision-making frameworks. To reflect these differences, the Toolkit includes institution-specific guidance that aligns measurement approaches with each organisation’s objectives and complements existing frameworks, enabling institutions to build on what they already use while filling gaps where more structure or clarity is needed.

A Clear Impact Pathway

At the heart of the Toolkit is the A&R impact pathway, linking financial inputs to outputs, outcomes and longer-term impacts

By concentrating on the stages where measurement is most feasible and reliable, the Toolkit helps institutions make the value of their adaptation and resilience activities more visible and more comparable.

It also draws on the logic of the UNEP FI Portfolio Impact Analysis Tool and introduces two complementary types of indicators, enabling organisations to track both their internal progress and the real-world A&R impact of their financing:

- Results indicators capture real-world A&R improvements delivered by financed activities

- Practice indicators reflect the internal processes, systems and capabilities that enable institutions to drive those results.

The Toolkit aims to provide an interactive starting point for financial institutions to begin generating and using these different indicator types as meaningful decision metrics across a range of financing activities and sectors.

Cadlas Senior Specialist and co-author of the toolkit, Noah Wescombe, notes the value of this approach:

What makes this toolkit uniquely useful to financial institutions is that it not only draws on diverse consultation from across the UNEPFI membership and its CAIL network but also provides a progressive approach to A&R measurement with multiple entry-points for organisations at different stages in their resilience journey.

Looking Ahead

While A&R measurement will always involve a degree of complexity, the Adaptation and Resilience Impact Measurement Toolkit offers a grounded and practical way forward. It supports institutions in identifying where physical climate risk matters most in their portfolios, what can be realistically measured and how this information can inform meaningful action.

The need for scaled up A&R financing is growing rapidly as climate impacts intensify and regulatory requirements increase. Financial institutions that strengthen their A&R measurement practices today will be better positioned tomorrow to scale responsibly, attract capital, manage risks and demonstrate genuine impact.

Cadlas looks forward to supporting our financial sector clients and wider stakeholders and partners to adopt and apply this toolkit, and to embed A&R measurement approaches and capabilities into their business practices and investment strategies.

Other Articles

Unlocking Adaptation Finance in ASEAN: The Launch of the mARs Guide Whitepaper

Unlocking Adaptation Finance in ASEAN: The Launch of the mARs Guide Whitepaper

The ASEAN region has made meaningful progress in recent years toward establishing a common language and framework for sustainable finance. At the centre of this effort is the ASEAN Taxonomy for Sustainable Finance (ASEAN Taxonomy), a classification system designed to guide capital flows into sustainable activities across ASEAN Member States (AMS).

The ASEAN Taxonomy aims to reduce fragmentation across jurisdictions, strengthen investor confidence and signal to markets and project developers which economic activities are likely to attract sustainable finance. While the taxonomy provides a solid foundation for advancing sustainable finance in the region, further enhancements to its usability and functionality for adaptation-specific purposes could play a significant role in unlocking additional investment for climate resilience.

To support this aim, the United Nations Environment Programme Finance Initiative (UNEP FI), the ASEAN Capital Markets Forum (ACMF), and the Sustainable Finance Institute Asia (SFIA) have released the Phase 1 Whitepaper on Key Principles and Methodological Approaches for the Development of the Mitigation Co-benefit and Adaptation for Resilience (mARs) Guide. This Whitepaper serves as the methodological starting point for developing the mARs Guide.

The mARs Guide is designed to complement the ASEAN Taxonomy by supporting users in conducting Environmental Objective 2 (EO2) assessments under both the Foundation Framework and the Plus Standard. It will outline the defining features of adaptation-related technologies and solutions within specific activities, including their purpose, role in adaptation, maturity, scalability, target beneficiaries, sphere of influence and potential environmental, social, and economic benefits including transformational impacts.

As Phase 1 of the mARs Guide development, the Whitepaper focuses on mapping national adaptation plans (NAPs) and related national strategies across AMS, along with reviewing international sustainable finance taxonomies and frameworks that address adaptation-related sectors. This mapping aims to identify shared principles, good practices, and methodological approaches that can be tailored to the ASEAN context. This ensures that the Guide is regionally relevant, evidence-based, and aligned with both local needs and global frameworks.

The Whitepaper also introduces a preliminary set of key principles to guide the design of the mARs Guide. These build on the five core principles of the ASEAN Taxonomy and the EO2 Guiding Principles, with added specificity for adaptation-related assessments:

- Science-based and evidence-led

- Context-relevant and locally prioritised

- Inclusive across ASEAN Member States

- Maladaptation risk management (uncertainty-aware)

- Interoperable and comparable

- Usable for finance and the real economy

Developed through extensive consultation with stakeholders across the region, including both users and providers of capital, the mARs Guide will supplement the ASEAN Taxonomy by clarifying what constitutes adaptation finance and how to assess resilience outcomes. In doing so, it reduces ambiguity, lowers transaction costs, increases comparability, and strengthens investor confidence. These improvements are essential for unlocking larger flows of public and private capital into climate adaptation projects and activities.

Cadlas remains committed to fostering a more resilient future by enabling informed, impactful investment in climate adaptation and resilience across ASEAN. We look forward to sharing further updates on how the mARs Guide will help transform the region’s sustainable finance landscape.

Other Articles

Resilience Unpacked: Investor Stewardship for Climate Resilience

Welcome to the third instalment of Resilience Unpacked, Cadlas’ insights series exploring key topics in climate resilience finance. In this edition, we explore how investors can use stewardship and engagement to drive climate resilience.

In Part 1 of this series on investor stewardship, we’ll look at how physical climate change impacts are emerging as a mega-trend for the investment industry and how responsible investment and climate resilience are increasingly integral to investors’ fiduciary duty.

As physical climate impacts intensify, investors are increasingly recognising the need to move beyond physical climate risk assessment and disclosure to support companies and assets in maintaining long-term value while adapting to a changing and more variable climate. In 2025, the World Economic Forum ranked extreme weather among the top risks to the global economy, while S&P Global estimated that the world’s largest companies could face annual costs of up to USD 1.2 trillion by 2050 due to physical climate risks. These figures underscore a clear message: the financial implications of a changing climate are material, measurable and mounting.

For the investment industry, this means adaptation and resilience can no longer be treated as peripheral sustainability issues. They must become central to how capital is allocated, how risks are managed and how long-term value is created and maintained.

Beyond Risk Disclosure

Over the past decade, the investment community has made meaningful progress in understanding and reporting on physical climate risks. Disclosure frameworks that cover climate scenario analysis, disclosure and risk assessment are now well established in a number of jurisdictions. However, most of these efforts still focus on assessing and disclosing physical climate risks, but often stopping short of responding to them. As climate impacts accelerate, investors will increasingly need to turn that analysis into action. This means using stewardship, including engagement with companies, influencing governance and exercising ownership rights, to build resilience within the companies and markets they invest in.

At its core, the shift is about turning climate awareness into climate action and recognising that resilience is not just a defensive measure, but a strategic imperative that protects and enhances long-term value.

Cadlas’ Investor Stewardship for Climate Resilience Sourcebook was developed in consultation with leading investors and investment industry associations to set out what this looks like in practice. It provides a blueprint that investors may use to embed physical climate risk considerations into their stewardship strategies and to work collectively to strengthen climate resilience across portfolios and markets. Importantly, it takes a pragmatic approach, offering pathways that investors can integrate into existing stewardship processes rather than creating entirely new initiatives.

Resilience and Fiduciary Duty

For investors, climate resilience is becoming an essential component of fiduciary duty. Acting with prudence and care in the face of physical climate risks requires understanding how those risks could affect assets, portfolios and broader market systems. It also requires supporting investee companies to anticipate, manage, and adapt to those risks effectively.

Reducing exposure to – or even divesting from – high-risk sectors or geographies may reduce portfolio exposure in the short term, but it can also undermine systemic resilience by cutting off capital from where it is most needed to build resilience. In contrast, maintaining engagement and using stewardship to encourage stronger risk management, adaptive planning and capital investment in resilience can drive both financial and social value. This approach parallels the logic of how responsible investment addresses decarbonisation challenges. Just as responsible investors understand that they need to stay engaged in hard-to-abate sectors to support low-carbon transition, they must also stay engaged in climate-vulnerable sectors to support their journey towards climate resilience.

However, investors’ approaches will differ based on their mandate, capacity, and risk appetite.

- Risk appetite: Investors with a higher risk appetite may choose to allocate capital to emerging resilience solutions or invest in companies operating in climate-vulnerable regions, recognising the potential for higher impact and longer-term value creation. Those with a lower risk appetite may instead focus on well-established resilience strategies or investments with more predictable risk-return profiles.

- Market of operation: Investors operating in markets that are highly exposed to physical climate risks may prioritise direct engagement with portfolio companies to strengthen adaptive capacity, while investors in more mature markets with stronger policy frameworks may focus on advancing market-level solutions.

- Size and capacity: Larger investors are often equipped to conduct detailed physical risk assessments, integrate resilience into governance and strategy, and lead collaborative stewardship initiatives. Smaller investors may need to prioritise the most material risks and leverage partnerships, pooled engagements, or service providers to extend their reach.

Whatever the approach, the key principle is consistency: ensuring that climate resilience is recognised as integral to fiduciary responsibility and long-term value creation.

- Integrate physical climate risk into investment policies, processes, and decision-making;

- Use robust data and scenario analysis to identify, understand, and manage material physical risks;

- Engage with portfolio companies and managers to strengthen governance, strategy, risk management, and disclosure around climate resilience;

- Identify and pursue opportunities that contribute to building resilience across markets and value chains; and

- Monitor, evaluate, and report on resilience performance and stewardship outcomes.

To explore this topic in more depth, download the Cadlas Investor Stewardship for Climate Resilience Sourcebook here or follow our Resilience Unpacked series on our website and our LinkedIn page. We welcome feedback on this topic and invite investors, policymakers and practitioners interested in advancing climate resilience through stewardship to connect with Cadlas at [email protected]

Stay tuned for Part 2, where we will unpack how investor stewardship for climate resilience can be applied in practice and explore approaches for structuring effective engagement for climate resilience.

Other Articles

Building Momentum for Adaptation Investment: Reflections from CAIP 2025

Building Momentum for Adaptation Investment: Reflections from CAIP 2025

Last week, Cadlas had the privilege of supporting the Asian Development Bank (ADB) in advancing its adaptation and resilience investment planning work at this year’s Climate Adaptation Investment Forum (#CAIP2025).

The conversations in Manila showed just how far the community of practice has come since we last gathered. Engagement was stronger, the discussions deeper, and the appetite for investment—both public and private—much clearer. There is clearly much more work to do, but to see this much progression and commitment to the process in only a year is very encouraging indeed.

We were honoured to have our own Noah Wescombe leading the conversation in two key sessions:

• Project Preparation Facilities for Adaptation – exploring how to design, structure, and scale the pipelines of projects that will ultimately mobilise finance, as well as the effective, sustainable models for maintaining PPFs for adaptation with national ownership.

• Country access to international markets and match-making – discussing how countries can unlock international capital and connect with private investors, while also noting the different levels of access and challenges faced in country readiness.

Both sessions gave us an excellent platform to share Cadlas’ recent work with ADB and the wider community, and to reflect on the lessons that can guide the next phase of CAIP’s growth.

Here are three of our key takeaways and lessons from #CAIP2025

• Country leadership is setting the pace. Certain countries are already innovating in policy, regulation, and practice. Their experience provides valuable lessons for others on how to overcome barriers and leverage opportunities.

• Private sector involvement is crucial. Public investment will remain essential, but we need more commercial banks, insurers, and investors in the room to bring scale and sustainability to adaptation finance.

• Metrics matter. Effective adaptation metrics are vital for planning and investment. If we can capture the financial as well as economic benefits of adaptation, we can give investors the confidence to commit capital.

Looking Ahead

At Cadlas, we see forums like CAIP as essential to turning ambition into action. The fact that adaptation investment is now firmly on the agenda (not just for governments and development partners, but also for private finance) is an encouraging sign of the shift underway.

We thank our colleagues at ADB, IIED, and across the CAIP community of practice for such a collaborative and inspiring week. We look forward to continuing to support this process, helping to translate national priorities into investable pipelines, and ensuring that finance is mobilised at the scale required.

Together, we can build a climate-resilient future—one investment at a time.

Other Articles

The Cadlas Sourcebook on Investor Stewardship for Climate Resilience

The Cadlas Sourcebook on Investor Stewardship for Climate Resilience: A Practical Resource for Embedding Climate Resilience into Investment Practices

After extensive consultations across the investment industry, Cadlas is pleased to announce the release of our Investor Stewardship for Climate Resilience Sourcebook. This new resource provides a practical framework for investors to align their stewardship practices with climate resilience goals. It lays out how investors can diagnose and understand physical climate risks, prioritise engagement with vulnerable companies and assets, and provide stewardship that drives the adoption of best practices on climate resilience across portfolios.

As the physical impacts of climate change intensify, investors face a defining challenge and opportunity. From floods and wildfires to water stress and heatwaves, physical climate hazards are becoming more frequent, more severe and more financially material. In this context, investors are increasingly recognising that identifying and disclosing physical climate risks is no longer enough. What is required is a shift from risk awareness to resilience action integrated directly into the way investors engage with the companies and assets they own.

The Investor Stewardship for Climate Resilience Sourcebook fills a critical gap in the market for tools and guidance that move beyond disclosure toward actionable investor engagement. It does not seek to reinvent existing investment processes, but instead demonstrates how climate resilience can be embedded within them through flexible and adaptive engagement strategies.

Importantly, the sourcebook builds on the growing body of work developed by leading investment industry bodies in recent years, aiming to advance action by focusing on the specific role investors can play in shaping a climate-resilient real economy.

This work emphasises that promoting climate resilience is aligned with investors’ fiduciary duties, encouraging investors to remain engaged and support climate resilience through targeted stewardship. It also highlights the need for tailored strategies across asset classes and geographies, while offering a curated toolkit of key resources.

By focusing on stewardship as a key instrument for advancing climate resilience, the sourcebook spells out how investors can strengthen long-term performance, manage systemic risks, and contribute to a more resilient and inclusive economy.

As physical climate impacts continue to grow in scope and scale, collaborative stewardship will be essential for unlocking the capital, capabilities, and influence needed to drive meaningful change. The time for passive risk management has passed. Through the release of this sourcebook, Cadlas hopes to contribute towards more widespread investor action that treats climate resilience not as a niche concern, but a core investment imperative.

The Investor Stewardship for Climate Resilience Sourcebook is available for download now.

Cadlas is also pleased to announce our upcoming webinar “Investor Stewardship for Climate Resilience” scheduled for 1pm (BST) on July 16th 2025. Sign up here and stay tuned for more info!

Other Articles

Sustainability-Linked Financing for Climate Resilience (part 2)

In Part 1 of this Resilience Unpacked series on Sustainability-Linked Financing for Climate Resilience, we explored the largely untapped potential of sustainability-linked bonds (SLBs) and loans (SLLs) to drive progress on climate adaptation and resilience. Despite their success in supporting mitigation goals, our research found that these instruments have only rarely been used to target adaptation outcomes. However, the growing application of water-related KPIs in SLBs and SLLs may offer a meaningful entry point for change.

In Part 2, we dig deeper into how water-related KPIs and SPTs are currently used in SLBs and SLLs across different sectors. We’ll examine how these indicators map against industry benchmarks, any emerging trends and practices shaping this evolving landscape.

Assembling the Evidence Base

To understand current practices, we analysed a dataset of 151 SLBs and SLLs issued between 2019 and 2024 that included water-related KPIs. This data was sourced from the Environmental Finance Database. Our research focused on four water intensive but key priority sectors: i) agri-processing, ii) manufacturing & services iii) property & tourism and iv) primary agriculture. After filtering out instruments from sectors outside our scope and transactions without disclosed KPIs, we identified 36 relevant SLBs and SLLs comprising 20 bonds and 16 loans for further analysis.

These transactions span a range of sectors and geographies, offering valuable insight into how water-related targets are structured in real sustainability-linked finance deals. They also provide a practical foundation for assessing the ambition and comparability of these targets against established industry benchmarks.

Anchoring to Benchmarks: What’s Available and What’s Missing

One of the key challenges in assessing SPT ambition is the absence of standardised benchmarks across sectors. To address this, our analysis drew on several existing reference points:

- EU BREFs

These are comprehensive, technical resources that detail the Best Available Technologies (BAT) for a plethora of industries. While the focus is on integrated pollution prevention and control across industries, they often include information on energy, water use and wastewater management. These documents offer granular, production process level industry benchmarks that, while useful, require careful interpretation to avoid misapplication outside their specific industrial context. As a result, we based our analysis on BREF water benchmarks.

- Buildings industry benchmarks

We referenced environmental benchmarks developed by the Better Buildings Partnership (BBP) to support our analysis of the property & tourism sector. These provide practical environmental benchmarks for commercial buildings, such as offices and shopping centres. However, their specificity to commercial buildings such as office blocks and shopping malls means they are not directly applicable to other building types like residential buildings.

- Food & Agriculture Organisation (FAO) resources

We reviewed water-related data and guidance from the FAO AQUASTAT database as well as other FAO resources to support our analysis of the primary agriculture sector. While rich in information, methodological uncertainties around target-setting in primary agriculture prevented us from fully integrating these benchmarks into our analysis.

Water-Related KPI Categories in Practice

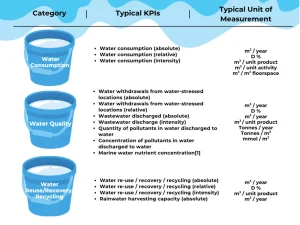

Our analysis revealed that water-related KPIs in SLBs and SLLs generally fall into three main categories: water consumption, water quality, and water reuse/recovery/recycling.

Water Consumption: These KPIs are the most widely used. These may be measured in absolute terms (e.g. cubic metres per year), in relative terms (e.g. percentage reduction in water consumption), or in terms of intensity – for example, water consumption per unit of product in manufacturing, per unit of activity in services, or per square metre in real estate. Some KPIs also focus specifically on water consumption from water-stressed regions, either in absolute or relative terms.

Water Quality: These KPIs tend to focus on the volume of wastewater discharged, either in absolute terms or in specific intensity terms and are commonly cited in BREFs. Some KPIs are qualitative and used to measure the wastewater pollutant load in terms of pollutant quantity or concentration.

Water Reuse/Recovery/Recycling: These KPIs are used in several sectors. These may be framed in absolute, relative, or intensity terms. A few transactions also include rainwater harvesting targets, although these are less common.

Table 1: Categorisation of water-related KPIs identified in the evidence base

Assessing Target Ambition: The Role of Second Party Opinions

In the absence of universally accepted benchmarks, SPTs in SLBs and SLLs are typically assessed by Second Party Opinion (SPO) providers. These providers use qualitative categories such as “insufficiently ambitious,” “moderately ambitious,” “ambitious,” and “highly ambitious” to rate the strength of a given target. While methodologies vary and are not always disclosed in full, two criteria consistently emerge.

First, SPOs often assess whether the target represents a meaningful improvement on the issuer’s past performance. This relies on transparent reporting of historic water use, which can be a challenge for some companies. Second, SPOs consider whether the target exceeds what is typical for the issuer’s sector. This comparative analysis depends on the availability of peer targets or recognised benchmarks, which are uneven across sectors.

Together, these criteria underscore the importance of both internal and external reference points in credible SPT design and the need for more consistent disclosure and benchmarking tools.

Sector-Specific Trends and Observations

The 36 SLBs and SLLs analysed reveal some important sector-level differences in how water-related KPIs and SPTs are used.

In the Agri-Processing sector, most water targets relate to consumption intensity, particularly in the beverage production sub-sector. Here, an ambitious target often involves a 10–20% reduction in water consumption intensity per unit (litre) of product. EU BREFs for the food, drink and milk industries also provide useful benchmarks for wastewater discharge intensity per unit of product, particularly in industries like brewing.

The Manufacturing & Services sector is highly diverse, spanning industries as different as pharmaceuticals, chemicals, paper & packaging, mining and logistics & services. Water KPIs here cover a broad range from water consumption in absolute terms in pharmaceutical production to wastewater discharge intensity in chemicals, plastics & rubber and paper & packaging, as well as water reuse/recovery/recycling in logistics & services. Given this diversity, setting credible targets requires deep industry-specific knowledge and benchmarking.

In the Property & Tourism sector, water consumption intensity is the dominant metric. Here, BBP benchmarks offer a relatively robust reference point for target setting. There is also at least one example of targets related to rainwater harvesting, although such these remain rare.

In contrast, the Primary Agriculture sector remains largely absent from the sustainability-linked finance landscape when it comes to water KPIs. Despite agriculture being the largest consumer of freshwater globally, our analysis found only one SPT in the livestock sub-sector, targeting absolute wastewater discharge. No examples were found for crop production despite it requiring the most significant amounts of water. While the ICMA KPI Registry provides many KPI recommendations, our research found little evidence of their practical use to set SPTs.

Looking Ahead

Our analysis across this Resilience Unpacked series highlights both the progress and the gaps in how water-related KPIs are used in SLBs & SLLs. While levels of rigour and benchmarking vary, what’s clear is that water offers a unique entry point for linking finance to resilience outcomes. Water is deeply connected to the impacts of climate change and increasingly measurable through performance-based metrics making it a natural candidate for integrating adaptation goals into mainstream financial instruments.

If we are to unlock the full potential of sustainability-linked finance for climate resilience, water-related KPIs could help lead the way. They offer a concrete, scalable foundation on which to build stronger, more credible frameworks that channel capital towards adaptation.

Thank you for following along with this Resilience Unpacked series on Sustainability-Linked Financing for Climate Resilience. Stay tuned for more from our Resilience Unpacked insights series and more!

Other Articles

Sustainability-Linked Financing for Climate Resilience (part 1)

Welcome to the second instalment of Resilience Unpacked, Cadlas’ insights series exploring key topics in climate resilience finance. In this edition, we examine sustainability-linked financing and its potential to support greater private investment in climate adaptation.

Results-based financing mechanisms such as Sustainability-Linked Bonds (SLBs) and Sustainability-Linked Loans (SLLs) tie financial terms to the achievement of sustainability goals. This creates incentives for companies to meet environmental performance targets. If structured around climate resilience-related Key Performance Indicators (KPIs), these instruments could channel much-needed private capital into adaptation measures at the corporate and entity level while setting powerful incentives for improving corporate performance on climate resilience.

Despite their growing popularity in supporting mitigation-focused corporate sustainability goals, SLBs and SLLs rarely incorporate adaptation and resilience objectives. This represents an underutilised opportunity to drive progress on adaptation and resilience. However, there may be important lessons from the application of sustainability-linked instruments in water-related investments that provide avenues for their potential role in financing climate resilience.

What are SLBs and SLLs?

Sustainability-Linked Bonds (SLBs) are general-purpose bonds that link financing terms, such as interest rates, to the achievement of predefined sustainability-related Key Performance Indicators (KPIs). If an issuer meets or falls short of its sustainability targets, financial terms may be adjusted accordingly.

Sustainability-Linked Loans (SLLs) function similarly but are structured as loans between a given lender and a given borrower, rather than bonds which are issued to raise funds from capital markets. Their terms also adjust based on performance against agreed sustainability KPIs.

Both instruments present an opportunity to incentivise investment in resilience by directly tying financing terms to progress on climate adaptation metrics. However, this opportunity has not been widely utilised across markets.

Limited Usage of Adaptation & Resilience Related KPIs

Despite the surge in sustainability-linked finance, adaptation KPIs remain strikingly rare. Research by Cadlas into global SLB issuances, using the Environmental Finance Database, found no examples of any specific adaptation or resilience KPIs included in global SLB issuances to date.

This trend was also observed in SLLs, with our research finding only one instance of climate adaptation as a KPI. HB Reavis, a UK-based real estate firm, secured a USD 32.4 million SLL in February 2024, which included a KPI linked to the number of EU Taxonomy-aligned buildings designed for climate adaptation. However, limited public information makes it hard to assess the robustness of this KPI.

This scarcity suggests potential uncertainty among issuers about how to define, implement, and measure adaptation KPIs. One key barrier is an unaddressed need for standardised guidance for adaptation-related KPIs in sustainability-linked finance.

Need for Clearer Guidance on Target Setting for Adaptation & Resilience

The International Capital Market Association (ICMA), a globally recognised standard-setting body, currently provides a limited number of KPIs that could convincingly be considered adaptation-related in the June 2024 iteration of its KPI Registry.

These are found in the Energy and Insurance (assets) sectors, representing only two out of ICMA’s twenty-six sectors. Within the Energy sector the adaptation-related KPI related to Share of energy produced in alignment with the EU Adaptation Taxonomy. While the KPI for the Insurance (assets) sector referred to the Proportion of invested assets managed with climate adaptation objectives.

Beyond these, ICMA lists three additional KPIs loosely linked to adaptation and all found within the Utilities (electricity) sector, but these lack clear resilience-focused outcomes. These include:

- Increase additional transformer capacity to facilitate interaction with the grid and integrate renewable energy generation,

- Increase power usage effectiveness/efficiency

- Renewable energy capacity (absolute or proportional).

This highlights the need for more detailed, targeted guidance on adaptation-related KPIs that are suitable for use in sustainability-linked debt instruments. Such guidance could build on existing best practices in financial sector adaptation and resilience metrics, such as the ARIC Adaptation & Resilience Impact Measurement Framework for Investors, developed in collaboration with UNEP-FI and Cadlas.

Water KPIs as a Proxy for Resilience in SLBs and SLLs

While adaptation-focused KPIs remain largely absent, water-related KPIs have gained significant traction, potentially serving as a stepping stone for broader resilience financing.

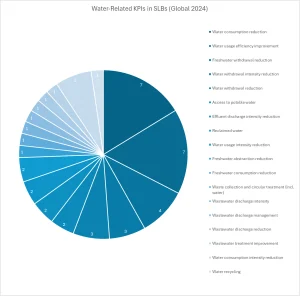

According to the Environmental Finance Database in 2024 there were:

- 43 SLBs valued at nearly USD 72 billion were issued globally with water-related KPIs by corporate borrowers

- The most common KPIs included water consumption reduction, efficiency improvements, and freshwater withdrawal reduction.

While several transactions did not specify precise bond KPIs, SLBs were categorised and grouped based on existing loan KPI details from the Environmental Finance Database and where possible, financing frameworks and other relevant publicly available documents.

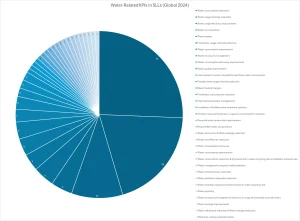

Water-Related KPIs in SLBs (Global Issuance, 2024)

The use of water-related KPIs appeared to be even more prevalent in SLLs, suggesting a stronger link between water management and this approach to sustainability-linked financing.

- 137 SLLs globally included water-related KPIs.

- The total lending volume of these SLLs reached USD 82.0 billion.

Of the one hundred and thirty-seven SLLs tagged by Environmental Finance as having water-related KPIs, only 121 could be categorised.

Water-Related KPIs in SLLs (Global Issuance, 2024)

Water-Related KPIs in the ICMA SLB KPI Registry

The water-related KPIs found in SLBs and SLLs from the Environmental Finance Database align closely with those listed in the ICMA SLB KPI Registry across a wide range of sectors including automotive, construction, energy, food and agriculture, finance, food & beverages, manufacturing, healthcare, maritime, metals & mining, retail, real estate, technology, transportation and utilities.

Across these sectors, water-related KPIs typically fall under six broad categories illustrated in the image below:

Six Categories in the ICMA SLB KPI Registry

These KPIs highlight the capacity for water to be used as a measurable, trackable and financeable resilience theme. However, while these KPIs offer a solid foundation, setting Sustainability Performance Targets (SPTs) against them remains a challenge.

From KPI to Impact: Driving Resilience & Improving Investor Confidence

Although water-related KPIs are common, the next hurdle is setting credible Sustainability Performance Targets (SPTs). SPTs tend to vary widely by issuer, sector and local context, and there is currently no standardised guidance for setting benchmarks or thresholds, especially for SLLs, where SPTs are rarely disclosed. This limits confidence and consistency across the market.

Despite this uncertainty around benchmarking & target-setting, SLBs still offer a powerful mechanism to incentivise financing broader resilience outcomes including water resource management.

The Anthropocene Fixed Income Institute (AFII) in their article ‘Rebuilding Confidence in the UK Water Sector,’ highlight the role SLBs can play in helping embattled UK water companies drive greater transparency on sustainability challenges, while also providing a financial hedge against poor performance for investors. AFII points out that by directly linking the cost of capital to measurable sustainability targets, water companies can improve investor confidence and build accountability.

Looking Ahead

At Cadlas, we are committed to driving innovation in sustainable finance that supports climate adaptation and resilience. One promising pathway lies in strengthening the design of SLBs and SLLs through more robust and relevant target-setting approaches. Developing clearer guidance for setting SPTs for water-related KPIs could be a practical and high-impact next step. This would not only reinforce the resilience link within SLBs and SLLs but also help build issuer and investor confidence in the adaptation value of these instruments.

By addressing these technical and strategic barriers, sustainability-linked finance can evolve into a more powerful mechanism for mobilising private investment in adaptation and resilience efforts. Water-related metrics, in particular, offer a compelling entry point for advancing this agenda. By anchoring SPTs in credible water-related KPIs, issuers can begin to demonstrate how sustainability-linked finance can deliver measurable adaptation outcomes. In doing so, they can help pave the way for wider market recognition of the role SLBs and SLLs can play in scaling climate resilience.

What’s Next?

In Part 2 of this Resilience Unpacked series on sustainability-linked finance, we’ll take a closer look at how water-related KPIs and SPTs are currently used in SLBs and SLLs across different sectors. We’ll examine how these indicators map against industry benchmarks, as well as analyse emerging trends and practices shaping this evolving landscape.

Other Articles

Insights from Resilience Unpacked: The Role of National Platforms in Unlocking Adaptation Investment

Insights from Resilience Unpacked: The Role of National Platforms in Unlocking Adaptation Investment

As climate risks intensify, the need to channel finance into adaptation has never been more urgent. Yet, despite more than a decade into formal national adaptation planning, implementation continues to lag behind. Cadlas’ recent webinar and panel discussion brought together leading experts Nanki Kaur from the Asian Development Bank (ADB), Michael Mullan from the Organisation of Economic Cooperation & Development (OECD), Bouke de Vries, independent expert and former advisor to the Executive Board of Rabobank and Danielle Evanson from the Government of Barbados’ Roofs-to-Reefs programme to explore how countries can and are already utilising national platforms to turn high-level adaptation policies into investment-ready strategies.

Unlocking the Potential of National Adaptation Plans (NAPs)

Nanki Kaur highlighted how National Adaptation Plans (NAPs) offer countries a structured way to assess climate risks and set sector-specific adaptation priorities. When done well, NAPs guide policy direction and investment planning, helping governments articulate both the urgency and strategic direction of their adaptation needs.

But turning these plans into investable projects is easier said than done. As Nanki pointed out, despite years of planning, adaptation financing remains elusive due in part to poor translation of climate risks into metrics that matter to investors. Many NAPs contain fragmented, small-scale solutions that fail to tackle adaptation at a systems level, and crucially, they’re often not well integrated into national public investment systems.

Making the Economic Case for Adaptation

Nanki also highlighted that one of the biggest challenges for countries has been demonstrating the value of adaptation. While there are many examples of economic modelling showing the costs of not adapting, very little analysis continues to be done on the benefits of proactive adaptation. This gap makes it harder for Ministries of Finance to justify adaptation investments or for private investors to see a business case for investing in adaptation.

To address this, ADB is supporting fourteen countries through its Climate Adaptation Investment Planning (CAIP) programme. This initiative focuses on aligning adaptation plans with public financial management systems and embedding economic analysis to assess the fiscal and financial returns of adaptation investment. This will in turn help governments to prioritise public funds where they are needed most, while steering viable projects towards private finance.

Building Institutional Architecture for Investment

Similarly, Michael Mullan underscored that effective adaptation planning requires robust cross-government coordination. While leadership often starts within specific ministries or agencies, unlocking finance and shifting national budgets requires collaboration from across all sectors and levels of government.

The OECD’s Climate Adaptation Investment Framework (CAIF) identifies six building blocks to integrate adaptation into investment planning including public finance mainstreaming, private investment support and sectoral regulation. To make this work, all parts of government need to be aligned. National platforms, Michael noted, can play a key role in strengthening institutional mechanisms, integrating climate risk into central government mandates and providing clearer planning signals to investors.

Lessons from Barbados’ Integrated Approach to Adaptation & Resilience

Danielle Evanson shared how Barbados is leading with an integrated, national platform approach through its “Roofs-to-Reefs” initiative. Rooted in the idea that climate resilience must stretch from households to coral reefs, the programme sits within the Prime Minister’s Office, enabling high-level coordination and oversight.

Roofs-to-Reefs operationalises adaptation planning by linking national policies, such as the Barbados Economic Recovery and Transformation (BERT) plan and Nationally Determined Contribution (NDC) with investment plans across six priority sectors including water, energy, waste, land use, ecosystems and housing. Importantly, this approach blends public and private investment, guided by a unified national vision.

Barbados has also turned to innovative financing tools to scale impact, structuring debt-for-nature and debt-for-climate swaps that mobilised investment from multilateral banks and domestic financial institutions. These mechanisms facilitated the establishment of the Barbados Environmental Sustainability Fund and the Blue Green Investment Bank, which is now in its operationalisation stage.

Engaging the Private Sector: Insights from the Netherlands

Bouke de Vries brought a unique perspective from the Netherlands Sustainable Finance Platform (SFP) convened not by a ministry, but by the Dutch Central Bank. The SFP aims to bring together stakeholders from the financial sector, government and scientific institutions to promote sustainability in the Netherlands. The platform makes recommendations for removing barriers to sustainable finance and is actively involved in pilots for sustainability initiatives.

In the SFP’s Climate Adaptation Working Group, members discuss what is needed to accelerate climate adaptation at the national level, with a particular focus on private sector stakeholders. Notably, this working group also includes the secretariat of the National Delta Programme’s commissioner.

Bouke highlighted that climate change poses a systemic risk which also affects the financial sector. It must therefore understand and manage these risks within its assets and client portfolios, with banks, insurers and institutional investors assessing, pricing, transforming, or avoiding them. Additionally, the financial sector contributes to adaptation and resilience by financing adaptation investments and insuring against risks. These are also important commercial opportunities.

Clear labels and taxonomies provide both urgency and clarity by helping to translate climate data into meaningful signals for market actors that can inform investment decisions. Well defined and actionable national adaptation strategies and targets are much needed to make adaptation more investable and bankable, as well as communication to businesses and people to raise awareness, enabling regulation and policies.

A Systems Shift Is Underway

If there was one overarching theme from the panel, it’s that climate adaptation can no longer be treated as an isolated policy issue. It must be understood as a systems issue, one that spans ministries, markets and entire economies.

Whether through national platforms like Barbados’ Roofs-to-Reefs, cross-sectoral coordination frameworks championed by the OECD, or regional investment planning supported by ADB, the shift from planning to financing adaptation is gaining traction. But for these efforts to succeed, countries must not only clarify their priorities they must also build the economic and institutional foundations that enable investment to flow.

Other Articles

Adaptation Finance becomes a highlight at UNEP FI Regional Roundtable

Adaptation Finance becomes a highlight at UNEP FI Regional Roundtable

Imagine a future where the financial sector is a powerful engine driving climate resilience across Latin America and the Caribbean. At Cadlas, we’re not just imagining it – we’re working to make it a reality!

Last week, our team had the privilege of helping to deliver the “Scaling Up Climate Adaptation Finance” workshop at the UNEP FI Regional Roundtable on Sustainable Finance in São Paulo. The room was buzzing with energy as participants from across the region came together to tackle one of the most pressing challenges of our time.

Collaboration is Key

Throughout the roundtable, we engaged in deep discussions on physical climate risk and adaptation finance.

A key takeaway? Collaboration is essential. By facilitating peer-to-peer dialogues and knowledge exchange, we saw firsthand how bringing diverse perspectives to the table can spark transformative ideas and solutions.

Piecing Together the Adaptation Finance Puzzle

So, what does it take to scale up adaptation finance? Our workshop participants identified several critical pieces of the puzzle:

- Locally-relevant taxonomies: Adaptation finance frameworks must be co-created with stakeholders to reflect the diverse realities on the ground.

- Alignment with policy: Embedding adaptation taxonomies within national policy instruments like NAPs is key for coherence and impact.

- Measuring what matters: Incorporating resilience and risk reduction KPIs into taxonomies can drive accountability and help track progress against adaptation goals.

- Growing the market: Capacity building and awareness-raising efforts are needed to position adaptation finance as a win-win for risk management and value creation.

Bridging Insights to Action

At Cadlas, we’re committed to turning these insights into action. That’s why we’re proud to be collaborating with the Climate Bonds Initiative on the groundbreaking Climate Bonds Resilience Taxonomy.

This taxonomy will provide a robust framework for identifying and scaling up climate resilience investments. And guess what? It’s grounded in the same principles of inclusivity, alignment, impact, and market development that emerged from the UNEP FI roundtable.

The Path Forward

As we continue to advance the Climate Bonds Resilience Taxonomy and engage with partners worldwide, one thing is clear: the sustainable finance community is a force to be reckoned with.

Together, we have the power to mobilize the capital needed to build a more resilient future for all. So, let’s keep breaking down silos, pushing boundaries, and daring to imagine a world where finance and sustainability go hand in hand.

Stay tuned for more updates on our work to scale up adaptation finance through the CAIL community of practice. And if you’re ready to join the movement, drop us a line! We’d love to explore how we can collaborate to drive climate resilience in Latin America, the Caribbean, and beyond.

Other Articles

National Platforms for Adaptation & Resilience (Part 2)

Welcome to the second instalment of Cadlas’ new insight blog series, Resilience Unpacked, where we explore key topics in climate resilience financing. In this edition, we focus on National Platforms for Adaptation and Resilience Investment.

National platforms or country platforms for climate action are country-led partnerships that align financing, coordinate stakeholders and connect national climate policies with financeable projects. They enhance collaboration, streamline funding and maximise climate impact by bridging the gap high-level national adaptation plans and financeable investments.

As demand for adaptation finance grows globally, national platforms are increasingly identified as important mechanisms for mobilising investment in climate adaptation and resilience initiatives. Strengthening and expanding these platforms will be key to transforming national climate policy ambitions into investable projects and unlocking the full potential of climate resilience investments for a more resilient future.

In Part 1 of our Resilience Unpacked series on national platforms, we explored exactly what they are and how they function. Now, we’ll take a closer look at their structure, organisation and the key stakeholders driving their work. Click here to read part 1 of this series

Structure of National Platforms for Adaptation & Resilience

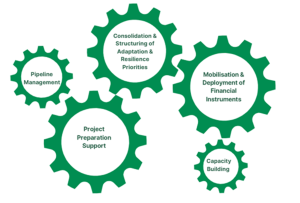

As explored in Part 1, national platforms for climate action integrate climate considerations into investment pipelines by embedding them into strategy, operations and decision-making processes.

While there is no universal model, these platforms typically achieve their objectives by consolidating national climate priorities, supporting project preparation and capacity building, enhancing project pipeline management and mobilising innovative financial instruments.

A defining characteristic of national platforms is that they are country-driven, meaning their structure varies based on national context. Despite differences in governance and institutional setup, these platforms generally engage a diverse set of stakeholders, including government entities, the private sector, civil society (including academia), and, in many cases, international organisations.

Stakeholder Roles in National Platforms

Stakeholders within national platforms work together to set the platform’s strategic direction, align investments with national adaptation priorities, mobilise funding, and develop investable adaptation project pipelines.

They also build institutional capacity, manage risks, coordinate community engagement to ensure local adaptation needs are met, and streamline funding between national governments and international financial institutions. These stakeholders generally fall into two main categories: leading and supporting stakeholders.

Leading Stakeholders

- Leading stakeholders play a key role in integrating national adaptation priorities into investment planning and financial supervision.

Supporting Stakeholders

- Supporting stakeholders help incorporate adaptation into sectoral investment planning and align community-level adaptation goals with national priorities.

- Depending on the institutional context, there may be other supporting stakeholders which contribute by managing risk and data, aligning projects with finance priorities, coordinating international funding, providing climate risk modelling, and promoting equity in adaptation efforts.

National Platforms in Action: Examples from Around the World

While national platforms have been widely used to support climate mitigation efforts, not many examples exist of their application in scaling up finance specifically for adaptation and resilience. However, international support for adaptation-focused national platforms is growing, with a consortium of MDBs publishing guiding principles for their development and implementation.

Key initiatives driving this momentum include the:

- Asian Development Bank’s (ADB) Climate Adaptation Investment Planning (CAIP) , which helps ADB partner countries translate national adaptation priorities into robust investment programmes by leveraging existing structures and strategies.

- International Monetary Fund’s (IMF) Resilience and Sustainability Facility (RSF ), which provides long-term financing to help countries strengthen economic resilience to climate risks.

As mentioned previously, the structure of a national platform varies based on country-specific needs and governance models. The following examples illustrate these differences, showcasing distinct stakeholder roles and levels of involvement.

The Netherlands Sustainable Finance Platform

Chaired by the De Nederlandsche Bank (DNB), the Netherlands’ Sustainable Finance Platform (SFP) is a great example of a financial sector driven national platform. The SFP brings together stakeholders across the financial sector including asset managers, the Dutch Banking Association, insurers and pension funds to work with government ministries to promote sustainability in the Netherlands through its financial sector.

A core feature of this platform is its working groups, which shape the platform’s thematic focus. Importantly, the SFP features an Adaptation Working Group which examines how the financial sector can support economic adaptation to climate change in four key sectors: built environment, agriculture, industry and transport. The group assesses scenarios, methods, and data required for financial institutions to evaluate climate risks and adaptation needs. While its outcomes are non-binding, its recommendations play an important role in strengthening collaboration between financial institutions, the government, and other stakeholders, ensuring that adaptation challenges are linked to financial sector actions.

The Bangladesh Climate and Development Platform

Bangladesh is among the most climate-vulnerable nations, making climate adaptation finance an urgent priority. Launched in 2023, the Bangladesh Climate and Development Platform (BCDP) is a government-led initiative established in collaboration with international financial institutions, bilateral donors, and the private sector. While not exclusively focused on adaptation and resilience, the platform aims to generate a robust pipeline of climate projects and financing strategies.

Building upon financing from long-term international development financing partners and an arrangement with the IMF’s Resilience and Sustainability Facility, the BCDP aims to improve the integration of climate risks into fiscal planning, enhance climate-sensitive public investment management and strengthen climate-related risk management for financial institutions. Under the BCDP, a project preparation facility will also be established to enhance project bankability, making climate projects more scalable and attractive to private investment.

The Way Forward for National Platforms for Adaptation & Resilience

By streamlining stakeholder collaboration, national platforms have become important mechanisms for mobilising finance for adaptation & resilience. The examples of the Netherlands and Bangladesh highlight how platforms can be tailored to meet country-specific needs to build resilience to the growing challenges of climate change.

As the demand for adaptation finance continues to rise, the success of these platforms will depend on strong, inclusive partnerships and a clear focus on locally led solutions.

This concludes our Resilience Unpacked series on National Platforms for Adaptation & Resilience. Thank you for joining us on this deep dive into national platforms and stay tuned for more from the Resilience Unpacked blogs series!

Other Articles